ZFX Broker Review: Versatile Trading on a Global Scale

ZFX Overviews

ZFX is a regulated online trading platform offering access to a variety of markets including forex, indices, commodities, and stocks. With powerful MetaTrader 4 integration, ZFX supports robust trading capabilities across multiple devices, including dedicated mobile apps. The platform emphasizes educational resources and tools like economic calendars and copy trading to enhance trading strategies. ZFX caters to all levels of traders with different account types, from Mini to ECN, tailored to individual trading needs and styles.

Founded in 2016 by Zeal Capital Market in London, ZFX is a UK forex and CFD broker situated in London, as part of the Zeal Group, ZFX offers trading in a variety of different asset classes to customers including forex, commodities, indices, and stocks. The firm is licensed by the UK’s Financial Conduct Authority (FCA) and Financial Services Authority (FSA) in Seychelles giving a secured environment to customers who will be trading from there.

ZFX adopts the No Dealing Desk model of execution that affords direct market access with competitive spread values and fast speeds of execution. The trading firm supports MetaTrader 4, popularly known for easy-to-use interfaces and developed trading tools. The brokerage firm has various types of accounts for retail and institutional clients.

Along with the trading services, the company places importance on client fund security by segregating client funds from corporate assets and holding them separately in accounts at major banks. This enables the maximum safety and transparency from the trader’s point of view.

In summary, ZFX is a trusted broker that has a safe and efficient trading environment and its tight regulatory oversight and commitment to protect clients’ funds.

- Dual regulation by FCA (UK) and FSA (Seychelles)

- Client funds are fully segregated

- Negative balance protection available

- Minimum deposit starts at $50 (Mini Account)

- Competitive spreads from 0.2 pips (ECN Account)

- Three account types catering to different trader levels

- MetaTrader 4 platform with advanced tools

- 60+ forex pairs and multiple CFD instruments

- No dealing desk (NDD) execution model

- Not available in US, EU, and several other jurisdictions

- Limited range of trading instruments compared to competitors

- Higher minimum deposit ($1,000) for ECN accounts

Pros and Cons

- Educational Resources: ZFX offers the A-to-Z Trading Academy, providing educational materials suitable for traders at all levels.

- MetaTrader 4 Platform: The broker supports the widely-used MetaTrader 4 platform, known for its user-friendly interface and advanced trading tools.

- Low Initial Deposit: Traders can start with a minimum deposit as low as $50, making it accessible for beginners.

- Regulatory Compliance: ZFX is regulated by reputable authorities, including the UK's Financial Conduct Authority (FCA) and the Seychelles Financial Services Authority (FSA), ensuring a secure trading environment.

- Limited Product Range: Compared to some competitors, ZFX offers a narrower selection of trading instruments.

- Geographical Restrictions: The broker's services are not available in certain countries, limiting its global accessibility.

- High Minimum Deposit for ECN Accounts: Access to ECN accounts requires a minimum deposit of $1,000, which may be a barrier for some traders.

Is ZFX Safe? Broker Regulations

ZFX operates under the regulatory oversight of two primary authorities:

- Financial Conduct Authority (FCA): ZFX’s UK entity, Zeal Capital Market (UK) Limited, is authorized and regulated by the FCA under registration number 768451. The FCA is renowned for its stringent regulatory standards, ensuring that brokers adhere to high levels of transparency and fairness.

- Financial Services Authority (FSA) of Seychelles: Another entity of ZFX, Zeal Capital Market (Seychelles) Limited, is regulated by the FSA under license number SD027. While the FSA’s regulatory framework is considered less stringent compared to the FCA, it still provides a level of oversight for brokers operating under its jurisdiction.

Security Measures:

- Segregation of Client Funds: ZFX ensures that clients’ funds are fully segregated in designated client bank accounts, separate from the company’s operational funds. This practice safeguards clients’ assets, ensuring they are not used to meet the company’s liabilities.

- Data Protection: The broker employs robust security protocols to protect clients’ personal and financial information, adhering to international data protection standards.

In summary, ZFX’s regulatory compliance with both the FCA and FSA, combined with its commitment to fund segregation and data security, underscores its dedication to providing a safe trading environment for its clients.

- Financial Conduct Authority (FCA)

- Financial Services Authority (FSA) of Seychelles

What Can I Trade with ZFX?

ZFX offers a diverse range of trading instruments across multiple asset classes, providing traders with various opportunities to diversify their portfolios.

- Forex: Trade over 60 currency pairs, including major, minor, and exotic pairs, allowing for extensive forex market participation.

- Commodities: Access to precious metals like gold and silver, as well as energy commodities such as crude oil and natural gas, enables traders to hedge against market volatility.

- Indices: Engage in trading contracts for difference (CFDs) on major global indices, including the NASDAQ 100 and S&P 500, offering exposure to broader market movements.

- Stocks: Trade CFDs on shares of leading companies, providing opportunities to capitalize on individual stock performance without owning the underlying assets.

While ZFX provides a comprehensive selection of instruments, it’s important to note that the broker does not currently offer cryptocurrency trading. This limitation may be a consideration for traders interested in digital assets.

Overall, ZFX’s range of tradable instruments caters to both novice and experienced traders, facilitating diverse trading strategies across various markets.

- Forex

- Stocks (Shares)

- Commodities

- Indices

How to Trade with ZFX?

Trading with ZFX is a straightforward process designed to accommodate both novice and experienced traders. Here’s a step-by-step guide to get you started:

- Account Registration:

- Visit the ZFX Website: Navigate to the official ZFX website and click on the ‘Open an Account’ button

- Complete the Registration Form: Provide the required personal information, including your name, email address, and phone number.

- Verify Your Identity: Upload necessary identification documents, such as a valid passport or driver’s license, along with proof of address.

- Visit the ZFX Website: Navigate to the official ZFX website and click on the ‘Open an Account’ button

- Download the Trading Platform:

- MetaTrader 4 (MT4): ZFX utilizes the MT4 platform, renowned for its user-friendly interface and advanced trading tools. Download the platform compatible with your device (Windows, Mac, iOS, or Android) from the ZFX website.

- Fund Your Account:

- Deposit Methods: ZFX offers various funding options, including bank transfers, credit/debit cards, and e-wallets.

- Minimum Deposit: The minimum deposit requirement varies by account type, starting from $50 for the Mini Trading Account.

- Platform Login:

- Launch MT4: Open the MT4 platform and log in using the credentials provided during registration.

- Server Selection: Ensure you select the correct server associated with your ZFX account.

- Navigating the Platform:

- Market Watch: View available trading instruments and their real-time prices.

- Charts: Access customizable charts to analyze market trends.

- Navigator: Utilize tools, indicators, and expert advisors to enhance your trading experience.

- Placing a Trade:

- Select an Instrument: Double-click on your chosen asset in the Market Watch window.

- Order Window: Specify trade parameters, including volume (lot size), stop-loss, and take-profit levels.

- Execute Trade: Click ‘Buy’ or ‘Sell’ to open a position.

- Monitoring and Managing Trades:

- Terminal Window: Track open positions, account balance, and trading history.

- Modify Orders: Adjust stop-loss and take-profit levels as needed.

- Close Positions: Right-click on an open trade and select ‘Close Order’ to exit the position.

Tools and Features:

- Technical Indicators: MT4 offers a wide array of built-in indicators for comprehensive market analysis.

- Expert Advisors (EAs): Automate trading strategies using EAs, which can be customized or sourced from the MT4 community.

- One-Click Trading: Execute trades swiftly with a single click, ideal for fast-moving markets.

- Charting Tools: Utilize various chart types, timeframes, and drawing tools to perform technical analysis.

By following these steps and leveraging the robust features of the MT4 platform, you can effectively navigate the trading process with ZFX.

How Can I Open ZFX Account? A Simple Tutorial

Opening an account with ZFX is a straightforward process designed to accommodate both novice and experienced traders. Follow this step-by-step guide to set up your account:

- Registration:

- Visit the ZFX Website: Navigate to the official ZFX website and click on the “Open an Account” button.

- Complete the Registration Form: Provide your full name, email address, phone number, and create a secure password.

- Submit the Form: After filling in the required details, submit the registration form to proceed.

- Account Selection:

- Choose an Account Type: ZFX offers three account types:

- Mini Trading Account: Designed for beginners with a minimum deposit of $50 and leverage up to 1:2000.

- Standard STP Trading Account: Suitable for intermediate traders with a minimum deposit of $200 and leverage up to 1:2000.

- ECN Trading Account: Tailored for advanced traders with a minimum deposit of $1,000 and leverage up to 1:2000.

- Select Your Preferred Account: Based on your trading experience and capital, choose the account type that best suits your needs.

- Choose an Account Type: ZFX offers three account types:

- Identity Verification:

- Log into MyZFX: Access your personal area using the credentials created during registration.

- Upload Identification Documents: Provide a valid proof of identity (e.g., national ID card, driver’s license, or passport) and proof of residence (e.g., recent utility bill or bank statement not older than six months).

- Submit Documents: Ensure all documents are clear and legible before submission.

- Bank Account Verification:

- Access Payment Verification: Within MyZFX, navigate to “Personal Information” and select “Payment Verification.”

- Enter Bank Details: Provide your bank account information and upload a bank statement not older than six months.

- Submit for Verification: Confirm the details and submit for approval.

- Approval Process:

- Review Period: ZFX typically reviews verification documents within 24 business hours.

- Notification: You will receive an email notification once your account is verified and approved.

- Funding Your Account:

- Log into MyZFX: Access your personal area.

- Select Deposit Method: Choose from available funding options such as bank transfer, credit/debit card, or e-wallets.

- Complete the Deposit: Follow the prompts to fund your trading account.

- Start Trading:

- Download the Trading Platform: Install the ZFX MT4 platform compatible with your device.

- Log into the Platform: Use your account credentials to access the trading platform.

- Begin Trading: Explore the platform features and start placing trades.

By following these steps, you can efficiently set up and begin trading with your ZFX account.

- Registration: Visit the ZFX website, click "Open an Account," and complete the registration form by providing your name, email, phone number, and a secure password. Submit the form to create your account.

- Account Selection: Choose from three account types—Mini (minimum deposit $50), Standard STP (minimum deposit $200), or ECN (minimum deposit $1,000)—based on your trading experience and capital.

- Identity Verification: Log into MyZFX, upload proof of identity (e.g., passport or driver's license) and proof of residence (e.g., utility bill), and submit the documents for verification.

- Bank Account Verification: Provide your bank details within MyZFX, upload a recent bank statement (not older than six months), and submit for approval.

- Start Trading: Fund your account via a preferred deposit method, download the ZFX MT4 trading platform, log in with your credentials, and begin trading.

ZFX Charts and Analysis

ZFX provides traders with robust charting and analytical tools through the MetaTrader 4 (MT4) platform, renowned for its comprehensive features and user-friendly interface.

Charting Tools:

- Multiple Chart Types: Traders can choose from various chart types, including line, bar, and candlestick charts, to suit their analysis preferences.

- Timeframes: MT4 offers nine different timeframes, ranging from one minute to one month, allowing for both short-term and long-term analysis.

- Customization: Charts are fully customizable, enabling traders to adjust colors, add indicators, and apply drawing tools to enhance their analysis.

Technical Indicators:

- Built-in Indicators: MT4 comes equipped with over 50 pre-installed technical indicators, such as Moving Averages, Relative Strength Index (RSI), and Bollinger Bands, facilitating in-depth market analysis.

- Custom Indicators: Traders have the option to create or import custom indicators using the MQL4 programming language, allowing for tailored analytical tools.

Analytical Tools:

- Drawing Tools: The platform provides various drawing tools, including trend lines, Fibonacci retracements, and geometric shapes, aiding in the identification of key support and resistance levels.

- Expert Advisors (EAs): MT4 supports automated trading through EAs, which can analyze market conditions and execute trades based on predefined criteria.

Usability for Different Trading Styles:

- Beginners: The intuitive interface and extensive educational resources make MT4 accessible for novice traders, enabling them to learn and apply technical analysis effectively.

- Intermediate Traders: The wide array of indicators and customization options cater to traders with moderate experience, allowing for the development and testing of diverse trading strategies.

- Advanced Traders: Experienced traders can leverage the platform’s advanced features, such as custom scripting and automated trading, to implement complex strategies and conduct comprehensive market analysis.

In summary, ZFX’s integration of the MT4 platform equips traders with a versatile set of charting and analytical tools, accommodating a broad spectrum of trading styles and expertise levels.

ZFX Account Types

ZFX offers a variety of account types to cater to traders with different experience levels and capital sizes. Below is an overview of each account type:

| Account Type | Minimum Deposit | Leverage (up to) | Spreads (from) | Features |

| Mini Trading Account | $50 | 1:2000 | 1.5 pips | Designed for beginners; allows trading with smaller lot sizes. |

| Standard STP Account | $200 | 1:2000 | 1.3 pips | Offers direct market access with no commissions; suitable for all traders. |

| ECN Account | $1,000 | 1:2000 | 0.2 pips | Provides the lowest spreads with a commission per trade; ideal for advanced traders. |

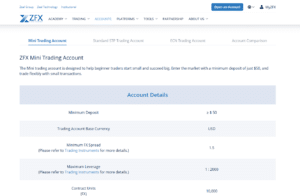

- Mini Trading Account:

- Minimum Deposit: $50

- Leverage: Up to 1:2000

- Spreads: Starting from 1.5 pips

- Features: This account is tailored for novice traders, allowing them to start with a modest investment and trade smaller lot sizes, thereby minimizing risk exposure.

- Standard STP Account:

- Minimum Deposit: $200

- Leverage: Up to 1:2000

- Spreads: Starting from 1.3 pips

- Features: The Standard Straight Through Processing (STP) account offers direct market access without any commissions, making it suitable for traders seeking competitive spreads and efficient execution.

- ECN Account:

- Minimum Deposit: $1,000

- Leverage: Up to 1:2000

- Spreads: Starting from 0.2 pips

- Features: The Electronic Communication Network (ECN) account provides access to the tightest spreads available, with a commission charged per trade. This account is ideal for experienced traders who require optimal trading conditions and are comfortable with higher initial deposits.

- Each account type is designed to meet the specific needs of traders, offering varying levels of leverage, spreads, and features to accommodate different trading strategies and risk appetites.

Do I Have Negative Balance Protection with This Broker?

Negative Balance Protection (NBP) is a crucial feature that ensures traders do not lose more money than they have deposited, safeguarding them from incurring debts due to adverse market movements.

ZFX offers Negative Balance Protection to its clients, ensuring that traders’ losses do not exceed their account balance. This means that in volatile market conditions, where leveraged positions might lead to significant losses, ZFX will reset the account balance to zero, preventing traders from owing money to the broker.

Impact on Trader Risk Management:

- Leverage Risks: While leverage can amplify profits, it also increases potential losses. NBP mitigates the risk of traders falling into negative equity due to leveraged positions.

- Market Volatility: During periods of high volatility, rapid price movements can lead to substantial losses. NBP acts as a safety net, capping losses at the account balance.

- Peace of Mind: Knowing that losses are limited to the deposited amount allows traders to strategize without the fear of incurring debts beyond their investment.

It’s essential for traders to understand that while NBP provides a layer of protection, it does not eliminate the inherent risks associated with trading. Implementing sound risk management practices, such as setting stop-loss orders and avoiding over-leveraging, remains vital.

In summary, ZFX’s provision of Negative Balance Protection enhances its commitment to client safety, allowing traders to engage in the markets with an added level of security.

ZFX Deposits and Withdrawals

ZFX Deposits and Withdrawals

ZFX offers a variety of deposit and withdrawal methods to accommodate the diverse needs of its clients.

Deposit Methods:

- Bank Transfers: Clients can fund their accounts via bank transfers, which may take several business days to process.

- Credit/Debit Cards: Visa and MasterCard are accepted, providing instant funding options.

- E-Wallets: Supported e-wallets include Skrill, Neteller, and Perfect Money, popular among forex traders for their convenience and speed.

Withdrawal Methods:

- Bank Transfers: Withdrawals to bank accounts are available, with processing times varying depending on the bank’s policies.

- Credit/Debit Cards: Funds can be withdrawn back to the original card used for the deposit.

- E-Wallets: Withdrawals to e-wallets like Skrill, Neteller, and Perfect Money are supported, often processed within 24 hours.

Minimum and Maximum Transaction Amounts:

- Deposits: The minimum deposit amount varies by account type, starting from $50 for the Mini Trading Account.

- Withdrawals: The minimum withdrawal amount is $15, though this may depend on the chosen withdrawal method.

Fees:

ZFX does not charge fees for deposits or withdrawals. However, third-party providers or banks may impose their own fees, especially for currency conversions or international transactions.

Processing Times:

- Deposits: Credit/debit card and e-wallet deposits are typically instant, while bank transfers may take several business days.

- Withdrawals: ZFX aims to process withdrawal requests within 24 hours. The actual time for funds to appear in your account depends on the withdrawal method and any intermediary banks involved.

It’s advisable for clients to verify their accounts and payment methods to ensure smooth and timely transactions. Additionally, being aware of any potential fees from banks or payment providers can help in managing costs effectively.

Support Service for Customer

ZFX is committed to providing comprehensive customer support to assist traders with their inquiries and technical needs.

Support Channels:

- Live Chat: Accessible directly through the ZFX website, offering real-time assistance for immediate concerns.

- Email Support: Clients can reach out via email at [email protected] for detailed inquiries or support requests.

- Phone Support: Available at 400-8424-611, with operating hours from Monday to Friday, 24 hours, and on weekends from 07:30 AM to 02:00 AM the next day.

Availability Hours:

- Weekdays: 24-hour support from Monday to Friday.

- Weekends: Support available from 07:30 AM to 02:00 AM the following day.

Languages Supported:

ZFX offers customer support in multiple languages, including:

- English

- Chinese

- Thai

- Vietnamese

- Indonesian

This multilingual support ensures that clients from various regions can communicate effectively with the support team.

Response Times:

ZFX aims to provide prompt responses to client inquiries. Live chat typically offers immediate assistance, while email responses are generally provided within 24 hours. Phone support is available during the specified hours for direct communication.

In summary, ZFX’s customer support infrastructure is designed to offer timely and effective assistance through various channels, accommodating clients’ preferences and ensuring a satisfactory trading experience.

Prohibited Countries: Where Can I Not Trade with this Broker?

ZFX operates under specific regulatory frameworks that restrict its services in certain jurisdictions. According to the broker’s policies, ZFX does not accept clients or offer its products and services to residents of the following countries:

- United States

- Brazil

- Canada

- Egypt

- Iran

- North Korea (Democratic People’s Republic of Korea)

- European Union (EU) countries

These restrictions are in place due to regulatory requirements and compliance standards that ZFX adheres to. For instance, the broker is regulated by the Financial Conduct Authority (FCA) in the UK and the Financial Services Authority (FSA) in Seychelles, which impose specific guidelines on the broker’s operations.

It’s important for potential clients to verify their eligibility based on their country of residence before attempting to open an account with ZFX. Engaging with a broker that does not operate in compliance with local regulations can lead to legal complications and potential financial risks.

For residents of countries where ZFX’s services are restricted, it’s advisable to seek alternative brokers that are authorized to operate within their jurisdiction. Always ensure that the chosen broker is regulated by a reputable authority and complies with the financial regulations of your country.

Special Offers for Customers

ZFX provides various promotions to enhance the trading experience for its clients. These offers are designed to provide additional value and encourage active trading.

Deposit Bonus:

ZFX offers a deposit bonus of up to $5,000 to boost trading potential. To qualify, clients must register a trading account and verify their personal details. The bonus is available for one trading account per new client during the promotional campaign.

No Deposit Bonus:

For new traders, ZFX provides a $10 no-deposit bonus, allowing them to experience real market conditions without financial risk. This bonus enables new traders to utilize all trading features available. Profits can be withdrawn after fulfilling the specified trading conditions.

IB Partnership Program:

ZFX offers an Introducing Broker (IB) partnership program with functionalities to grow businesses, whether startups or conglomerates. The program includes rebate options and commission setups, providing opportunities for partners to earn by referring new clients.

Terms and Conditions:

Each promotion comes with specific terms and conditions, including eligibility criteria, validity periods, and withdrawal requirements. Clients are advised to review these details on the ZFX website or contact customer support for comprehensive information.

By participating in these promotions, traders can enhance their trading capital and explore ZFX’s offerings more extensively. However, it’s essential to understand the associated terms to make informed decisions.

ZFX Review Conclusion: Reputable Broker with Easy-to-use Platform

ZFX has established itself as a reputable broker, offering a user-friendly platform that caters to both novice and experienced traders. The integration of the MetaTrader 4 (MT4) platform provides access to a wide range of trading instruments, including forex, commodities, indices, and stocks, facilitating diverse trading strategies.

Strengths:

- Regulatory Compliance: ZFX operates under the oversight of the UK’s Financial Conduct Authority (FCA) and the Seychelles Financial Services Authority (FSA), ensuring adherence to stringent financial standards.

- Diverse Account Types: The broker offers various account options, such as Mini Trading, Standard STP, and ECN accounts, accommodating traders with different experience levels and capital sizes.

- Educational Resources: Through the A-to-Z Trading Academy, ZFX provides educational materials suitable for traders at all levels, enhancing their trading knowledge and skills.

Areas for Improvement:

- Limited Product Range: Compared to some competitors, ZFX offers a narrower selection of trading instruments, which may limit diversification opportunities for traders.

- Geographical Restrictions: The broker’s services are not available in certain countries, limiting its global accessibility.

Usability:

The MT4 platform is renowned for its intuitive interface and advanced trading tools, making it accessible for beginners while offering the sophistication required by seasoned traders. Features such as customizable charts, a wide array of technical indicators, and support for automated trading through Expert Advisors (EAs) enhance the overall trading experience.

Customer Support:

ZFX provides comprehensive customer support through multiple channels, including live chat, email, and phone, with multilingual assistance available. This ensures that clients receive timely and effective support, contributing to a positive trading environment.

In summary, ZFX stands out as a reputable broker offering a user-friendly platform, diverse account types, and robust customer support. While there are areas for improvement, such as expanding the product range and addressing geographical restrictions, ZFX’s strengths make it a viable option for traders seeking a reliable and straightforward trading experience.

Summary and Key Takeaways

ZFX is a broker that balances usability with reliability, offering a secure platform for traders at various experience levels. While it could benefit from a broader asset selection and expanded geographic availability, its regulatory credentials, customer support, and MT4 platform make it a strong choice for many traders. ZFX’s combination of educational resources and account variety supports an inclusive trading experience, making it a solid option for both beginners and seasoned traders looking for a straightforward, secure trading environment.

- Regulatory Compliance: ZFX is regulated by the Financial Conduct Authority (FCA) in the UK and the Seychelles Financial Services Authority (FSA), offering a reliable trading environment backed by regulatory oversight.

- Trading Platform: With the popular MetaTrader 4 (MT4) platform, ZFX provides an intuitive and feature-rich trading experience suitable for both beginners and experienced traders.

- Account Options: The broker offers flexible account types, including Mini, Standard STP, and ECN accounts, which cater to traders with various experience levels and investment sizes.

- Asset Range: ZFX offers access to forex, commodities, indices, and stocks, though it lacks cryptocurrency trading options, which may limit diversification for some traders.

- Negative Balance Protection: ZFX provides Negative Balance Protection, ensuring that traders' losses are capped at their account balance.

- Promotions: Special offers like the deposit bonus and no-deposit bonus give clients opportunities to expand their trading capital, but these come with specific terms and conditions.

- Customer Support: Multilingual customer support is available through live chat, email, and phone, enhancing accessibility for clients globally.

FAQs

About Author

Beatrice Quinn

Beatrice Quinn Kingsley, a finance graduate from the London School of Economics, dove into finance clubs during her studies, honing her skills in portfolio management and risk analysis. With a career spanning prestigious firms like Barclays and HSBC, she's become an authority in asset allocation and investment strategy, known for her insightful reports. Beyond her corporate success, Beatrice is an advocate for financial literacy, actively engaging in workshops, seminars, and writing on topics like personal finance and investing. Recognized in the field, she's a featured voice in publications and a sought-after consultant, combining her financial know-how and communication prowess to empower ...User Reviews

Be the first to review “ZFX Broker Review: Versatile Trading on a Global Scale” Cancel reply

- ZFX Overviews

- Pros and Cons

- Is ZFX Safe? Broker Regulations

- What Can I Trade with ZFX?

- How to Trade with ZFX?

- How Can I Open ZFX Account? A Simple Tutorial

- ZFX Charts and Analysis

- ZFX Account Types

- Do I Have Negative Balance Protection with This Broker?

- ZFX Deposits and Withdrawals

- ZFX Deposits and Withdrawals

- Support Service for Customer

- Prohibited Countries: Where Can I Not Trade with this Broker?

- Special Offers for Customers

- ZFX Review Conclusion: Reputable Broker with Easy-to-use Platform

- Summary and Key Takeaways

- FAQs

- About Author

There are no reviews yet.