XTB Broker Review: Comprehensive Insights into Services and Features

XTB Broker Review Overviews

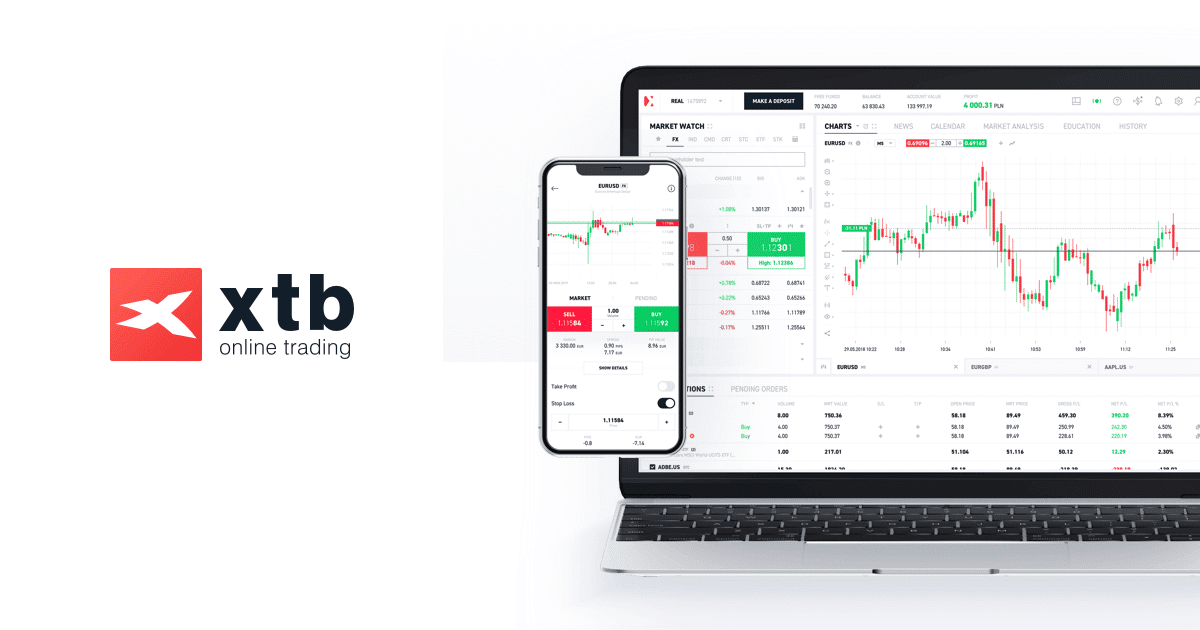

XTB is a well-regarded global broker founded in 2002, headquartered in Warsaw, Poland, and known for its powerful and user-friendly trading platform, xStation 5. XTB offers traders access to a wide range of over 2100 financial instruments across forex, CFDs, stocks, commodities, and cryptocurrencies. The broker is regulated by several top-tier authorities including the FCA and CySEC, ensuring a secure and transparent trading environment.

Founded in 2002, XTB is headquartered in Warsaw, Poland, and has grown to become one of the world’s leading trading platforms. As a publicly listed company on the Warsaw Stock Exchange, XTB has established a credible and transparent market presence, emphasizing its commitment to long-term trader success and financial proficiency.

XTB differentiates itself with a robust offering of over 2100 trading instruments across a wide spectrum of asset classes including Forex, Indices, Commodities, Stock CFDs, ETF CFDs, and Cryptocurrencies. This extensive range ensures that traders of all preferences and investment sizes can find opportunities that suit their trading strategies.

The broker is renowned for its state-of-the-art trading platform, xStation 5, which provides traders with superlative analytical tools, real-time performance statistics, and an intuitive user interface. xStation 5 is complemented by comprehensive educational resources, including webinars, video tutorials, and articles that cater to both novice and experienced traders. This dedication to trader education is a testament to XTB’s commitment to client empowerment and retention.

Throughout its history, XTB has received numerous awards and recognitions, reflecting its industry excellence and innovative approach. These accolades include being named the Best Forex Trading Platform by the Online Personal Wealth Awards and receiving high marks for its excellent customer service. Such achievements underscore the broker’s dedication to providing a superior trading experience that prioritizes user satisfaction and continuous improvement.

In addition to its technological and educational advancements, XTB maintains a strong ethical stance, upholding stringent regulatory standards. The broker is regulated by some of the world’s most respected financial authorities, including the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). These regulations ensure that all operational processes are conducted with the utmost integrity and transparency.

XTB also stands out for its customer-focused approach, offering personalized services tailored to meet diverse trader needs. This client-centric philosophy is evident in their 24/5 multilingual customer support and account management teams, which ensure that traders can receive guidance and assistance whenever needed.

Overall, XTB’s foundation of strong regulatory adherence, combined with its commitment to technological innovation and trader education, positions it as a reliable and respected leader in the global financial trading industry.

- Global Presence: XTB operates across Europe, Latin America, and Asia, serving diverse traders worldwide.

- Client Base: XTB serves over 495,000 global clients, meeting varied trading needs.

- Workforce: XTB employs 500+ staff, ensuring strong customer support and efficiency.

- Financial Stability: XTB’s solid financials boost operational resilience and trader confidence.

- Regulatory Compliance: XTB is regulated globally, ensuring transparency and trader protection.

- Technological Advancement: XTB offers advanced platforms and tools for enhanced trading performance.

Pros and Cons

- Advanced Trading Platform: XTB's xStation 5 is highly acclaimed for its user-friendly interface, cutting-edge technology, and comprehensive analytical tools, which enhance trading effectiveness and user experience.

- Extensive Range of Instruments: Traders have access to over 2100 instruments across various asset classes, including forex, indices, commodities, stock CFDs, and cryptocurrencies, catering to diverse trading preferences.

- Robust Educational Resources: XTB provides a wealth of educational materials, such as webinars, seminars, trading courses, and articles, supporting traders from novice to expert levels.

- Strong Regulatory Framework: XTB is regulated by major financial authorities like the FCA and CySEC, ensuring a high level of security and fair trading practices.

- Excellent Customer Service: Known for its responsive and helpful customer support available in multiple languages, enhancing the trading experience for global clients.

- Inactivity Fees: XTB charges fees for accounts that are inactive for extended periods, which might be a concern for infrequent traders.

- Limited Product Range in Some Regions: Depending on the trader’s location, some of XTB’s products, particularly certain stock CFDs and ETFs, may not be available.

- Withdrawal Fees: There are fees associated with bank wire withdrawals, which might be a drawback for some traders preferring this withdrawal method.

Is XTB Broker Review Safe? Broker Regulations

XTB operates with a high degree of regulatory compliance, which is crucial for ensuring the safety and security of its clients’ investments. Here are the key regulatory and safety measures in place at XTB:

-

Regulated by Top Authorities: XTB is stringently regulated by several of the world’s leading financial authorities, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Polish Financial Supervision Authority (KNF). These regulations guarantee that XTB adheres to the highest standards of financial practices and transparency.

-

Client Fund Segregation: XTB adheres to strict regulatory guidelines by keeping client funds segregated from the company’s operational funds. This segregation is crucial as it ensures that client assets are protected and cannot be used by the broker for any corporate activities, including business expenses.

-

Negative Balance Protection: To protect clients from losing more money than they have deposited, XTB offers negative balance protection. This feature is particularly important in volatile markets, as it prevents clients from ending up with a negative balance in their trading accounts.

-

Risk Management Tools: XTB provides various risk management tools to help traders control and limit their risk exposure. These tools include stop-loss orders, limit orders, and margin call alerts, which are essential for effective trading risk management.

-

Data Security: Ensuring the security of client data, XTB implements advanced encryption technologies and follows strict data protection protocols. These measures safeguard clients’ personal and financial information from unauthorized access and cyber threats.

-

Financial Stability: XTB’s strong financial health, evidenced by its public listing and transparent financial disclosures, further reassures clients of the broker’s reliability and commitment to long-term operational integrity.

- Financial Conduct Authority (FCA)

- Cyprus Securities and Exchange Commission (CySEC)

- Financial Supervision Authority (KNF)

What Can I Trade with XTB Broker Review?

XTB offers a diverse and expansive portfolio of trading instruments, making it an appealing choice for traders interested in exploring different financial markets. Here are the key asset classes available to trade with XTB:

-

Forex Trading: XTB provides access to a wide range of currency pairs, including major, minor, and exotic pairs. Traders can benefit from competitive spreads and leverage up to 30:1 for retail clients in the EU and UK, with higher leverage available for professional clients.

-

Indices: Traders at XTB can speculate on the performance of the world’s leading indices such as the US Tech 100, Germany 30, and UK 100. These offerings include both traditional indices and niche markets, providing ample opportunities for portfolio diversification.

-

Commodities: XTB offers trading on a variety of commodities including gold, silver, oil, natural gas, and soft commodities like coffee and sugar. This allows traders to hedge or take advantage of movements in these markets.

-

Stock CFDs and ETFs: With access to global stock markets, traders can engage in CFD trading on hundreds of stocks from the US, UK, and Europe, as well as a selection of ETFs. This provides flexibility to trade on both the price rises and falls of some of the biggest companies in the world.

-

Cryptocurrencies: For those interested in digital currencies, XTB offers trading on the most popular cryptocurrencies such as Bitcoin, Ethereum, Ripple, and more. This is particularly attractive given the growth and volatility associated with these assets.

- Forex

- Indices

- Commodities

- Stock CFDs and ETFs

- Crypto

How to Trade with XTB Broker Review?

Trading with XTB is streamlined and efficient, thanks to its user-friendly platform and comprehensive trading tools. Here’s a step-by-step guide on how to start trading with XTB:

-

Choose Your Platform:

- XTB offers its proprietary trading platform, xStation 5, which is renowned for its ease of use, speed, and depth of features. Traders can also opt to use the popular MetaTrader 4 platform. Both platforms are available on desktop, web, and mobile versions, allowing traders to engage with the markets from anywhere at any time.

-

Open and Fund Your Account:

- To begin trading, you need to open an account with XTB by providing some basic personal information and completing a verification process. Once your account is set up, fund it using one of the several available methods including bank transfer, credit/debit cards, or e-wallets. The minimum deposit is typically around $250.

-

Navigate the Trading Interface:

- XTB’s platforms are designed with the user in mind. The main trading interface displays a clear view of market prices, charts, and open positions. Traders can customize the layout according to their preferences, enabling them to access the tools they use frequently directly.

-

Analyze the Markets:

- Utilize XTB’s advanced analytical tools, including technical indicators, analytical objects, and charting tools. Traders can perform technical analysis to identify trends, support and resistance levels, and potential entry and exit points.

-

Place a Trade:

- To place a trade, select the asset you wish to trade, determine the volume (size of your trade), and then decide whether to buy or sell based on your market analysis. Before executing the trade, you can set stop-loss and take-profit orders to manage your risk.

-

Monitor and Close Your Position:

- After placing a trade, monitor its performance through the trading dashboard. You can adjust your stop-loss and take-profit orders as the market moves. To close a position, simply select it in the open positions window and choose to close, locking in any profits or losses at that time.

-

Review and Adjust Your Strategies:

- Regularly review the performance of your trades and overall strategy. XTB provides tools to analyze your trading history and performance statistics, helping you understand what strategies are working and what might need adjustment.

How Can I Open XTB Broker Review Account? A Simple Tutorial

Opening an account with XTB is designed to be straightforward and user-friendly, ensuring that traders can start their trading journey without any undue hassle. Here’s a step-by-step guide to setting up an account with XTB:

-

Visit the Official XTB Website:

- Start by navigating to XTB’s official website. Look for the ‘Create Account’ or ‘Register’ button, which is typically prominent on the homepage.

-

Complete the Registration Form:

- You will be prompted to fill in a registration form. This includes providing your personal details such as name, email address, phone number, and residential address. It’s important to ensure that all information is accurate to avoid any issues with verification.

-

Choose Your Account Type:

- XTB offers different account types, including Standard and Pro accounts. The Standard account typically offers higher spreads with no commissions, while the Pro account has lower spreads but includes commissions on trades. Select the account type that best suits your trading style and needs.

-

Verification of Identity and Residence:

- To comply with regulatory requirements, XTB requires you to verify your identity and residence. This can typically be done by uploading copies of your government-issued ID (such as a passport or driver’s license) and a recent utility bill or bank statement that shows your address.

-

Fund Your Account:

- Once your account is verified, you will need to deposit funds to start trading. XTB supports various funding methods, including bank transfers, credit/debit cards, and e-wallets like PayPal and Skrill. Check the minimum deposit requirements, which can vary depending on the account type and your region.

-

Familiarize Yourself with the Trading Platform:

- While your deposit is being processed, take the time to familiarize yourself with XTB’s trading platform, xStation 5. Explore its features, test different tools, and use the demo account to practice trading without any risk.

-

Start Trading:

- With your account funded and a good grasp of the trading platform, you’re ready to start trading. You can now access over 2100 financial instruments across various markets. XTB also offers educational resources and customer support to assist you in making informed trading decisions.

-

Continuous Learning and Account Management:

- Successful trading involves continuous learning and active account management. Utilize XTB’s educational resources, keep an eye on your trades, and adjust your strategies as needed. Regularly review your account performance and consider adjusting your trading approach based on market conditions and your trading results.

- Efficiency and Ease: The account opening process at XTB is efficient and straightforward, designed to facilitate quick access to the trading world.

- Regulatory Compliance: Verification steps ensure compliance with financial regulations, enhancing the security of your transactions.

- Support and Resources: XTB provides ample support through customer service and educational resources, aiding both new and experienced traders in navigating the complexities of trading.

XTB Broker Review Charts and Analysis

XTB provides traders with sophisticated charting tools and a wealth of analytical resources, enhancing the trading experience by enabling detailed market analysis. Here’s an overview of the charting and analysis features available on XTB’s platform:

-

Advanced Charting Tools: XTB’s trading platform, xStation 5, comes equipped with powerful charting capabilities designed to cater to the needs of both novice and expert traders. The platform offers over 35 drawing tools and more than 20 technical indicators, allowing traders to perform comprehensive technical analysis. The charts can be customized with different time frames, from one minute up to one month, providing flexibility depending on trading strategies.

-

Real-time Market Analysis: Traders at XTB benefit from real-time market analysis and news updates directly on the platform. This feature ensures that traders are always up-to-date with the latest market developments, which is crucial for making informed trading decisions.

-

Economic Calendar: The economic calendar on xStation 5 is a useful tool for all traders, especially those who follow fundamental analysis. It lists important economic events and indicators, along with their expected impacts on the markets, helping traders plan their trading activities around significant market movements.

-

Trader’s Calculator: Another notable feature is the Trader’s Calculator, which helps traders assess potential profits, losses, and risks before placing trades. This tool calculates margin requirements, pip value, and swap fees, among other trading variables, making it easier for traders to manage their positions effectively.

-

Performance Statistics: XTB’s platform provides detailed performance statistics that allow traders to analyze their trading history and behaviors. These insights can help traders identify their strengths and weaknesses and optimize their strategies for better results.

XTB Broker Review Account Types

XTB offers several account types tailored to meet the diverse needs of traders. Each account comes with its own set of features and benefits designed to accommodate different trading styles and experience levels. Below is an outline of the various account types available at XTB:

| Account Type | Features | Leverage | Spreads | Eligibility |

|---|---|---|---|---|

| Standard | No commission on trades; higher spreads. | Up to 30:1 | From 0.5 pips | Available to all retail traders. |

| Pro | Lower spreads; commission on trades. | Up to 30:1 | From 0.1 pips | Suitable for experienced traders. |

| Islamic | Swap-free accounts as per Sharia law. | Up to 30:1 | From 0.7 pips | Available to traders following Islam. |

| Demo | Risk-free with virtual funds to practice trading. | N/A | Simulated spreads | Open to anyone for practice. |

Key Features of Each Account Type:

-

Standard Account: This account is ideal for beginners and casual traders who prefer a straightforward trading experience without additional costs per trade. The higher spreads cover the trading costs, simplifying the trading process.

-

Pro Account: Aimed at more experienced traders who trade frequently and prefer to pay per transaction to benefit from tighter spreads. This account is optimal for those looking to trade large volumes.

-

Islamic Account: Provides a swap-free option in compliance with Islamic finance principles. This account eliminates swap fees on overnight positions, aligning with the religious beliefs of Muslim traders.

-

Demo Account: An excellent starting point for new traders or those looking to test XTB’s platform without financial risk. It replicates real market conditions and provides virtual funds for trading practice.

Each account type at XTB is designed with specific trader needs in mind, ensuring that both new and experienced traders can find an option that best suits their trading style and requirements.

Do I Have Negative Balance Protection with This Broker?

Negative balance protection is a crucial safety feature for traders, and XTB provides this protection to ensure that clients do not lose more money than they have deposited in their trading accounts. Here’s an in-depth look at how negative balance protection works at XTB and its implications for trader risk management:

-

What is Negative Balance Protection? Negative balance protection is a policy implemented by brokers to prevent clients from owing money beyond their account balance. This feature is particularly important in highly volatile markets, where rapid price movements can otherwise lead to significant losses that exceed the trader’s initial investments.

-

XTB’s Commitment to Safety: XTB ensures that all retail clients benefit from negative balance protection. This safeguard is part of XTB’s broader strategy to provide a secure trading environment and protect clients from unforeseen market risks. It reflects the broker’s commitment to upholding client interests and maintaining trust.

-

Mechanism of Protection: In practice, if a trading account at XTB falls into a negative balance due to market volatility or leveraged positions, the broker will automatically reset the account balance to zero. This means that traders will not be required to repay the negative balance, thus limiting their loss to the original amount deposited.

-

Regulatory Compliance: XTB’s provision of negative balance protection complies with regulatory requirements set forth by financial authorities like the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC). These regulations mandate that licensed brokers must offer this protection to retail clients, enhancing overall market integrity.

-

Risk Management Benefits: By offering negative balance protection, XTB helps traders manage their risk more effectively. This feature is especially valuable for novice traders and those using high leverage, as it provides a safety net against potentially devastating financial losses.

-

Trader’s Responsibility: While negative balance protection offers a significant safety layer, traders should not see it as a substitute for good risk management practices. It is advisable for traders to use other risk management tools available on XTB’s platform, such as stop-loss orders and setting appropriate leverage levels, to manage their trading exposure responsibly.

XTB Broker Review Deposits and Withdrawals

Handling deposits and withdrawals efficiently is essential for a seamless trading experience. XTB provides a variety of options for funding and retrieving money from trading accounts, detailed as follows:

-

Deposit Methods:

- Bank Wire Transfer: Allows for secure transfers directly from your bank account, typically processed within 2-3 business days.

- Credit/Debit Cards: Instant deposit options are available, making it one of the quickest ways to fund your account. XTB accepts major cards like Visa and MasterCard.

- E-Wallets: XTB supports several popular e-wallets, including PayPal, Skrill, and Neteller, providing fast and secure transactions.

-

Withdrawal Methods:

- Withdrawals at XTB can generally be made using the same methods as deposits. The broker aims to process withdrawal requests within one business day, although the time it takes for funds to reach your account will depend on the method used:

- Bank Transfers might take a few days to process.

- Credit/Debit Card withdrawals are usually processed quickly but can take up to 5 business days to reflect in your account depending on your bank.

- E-Wallets often provide the fastest withdrawal times, typically within 24 hours.

- Withdrawals at XTB can generally be made using the same methods as deposits. The broker aims to process withdrawal requests within one business day, although the time it takes for funds to reach your account will depend on the method used:

-

Minimum and Maximum Limits:

- XTB has set reasonable minimum deposit requirements, which can vary by region and account type. For most methods, the minimum deposit is generally around $250.

- There are no maximum deposit limits with XTB, but withdrawals may be subject to limits depending on the trader’s account verification status and the withdrawal method.

-

Fees:

- XTB does not charge any fees for deposits. However, withdrawals may incur fees, especially when using bank wire transfers. It is advisable to review the specific fees that may apply to your chosen withdrawal method.

- XTB tries to minimize these costs for traders where possible and provides transparent information about any applicable fees on their website.

-

Processing Times:

- XTB is committed to processing both deposits and withdrawals swiftly to ensure that traders can manage their funds effectively and without unnecessary delays. The broker’s efficiency in handling these transactions reflects its dedication to customer satisfaction and operational excellence.

-

Security Measures:

- All transactions are protected with industry-standard security protocols, including SSL encryption. XTB’s compliance with regulatory guidelines ensures that client funds are handled securely and with the utmost care.

Support Service for Customer

XTB places a high priority on providing excellent customer support to ensure a satisfactory trading experience for all its clients. Here’s a detailed look at the customer support options available at XTB:

-

Support Channels:

- Live Chat: XTB offers a live chat feature, which allows traders to get quick responses to their inquiries directly on the platform. This service is available 24/5, aligning with global trading hours.

- Phone Support: Traders can reach out to XTB’s customer service team via phone. This includes dedicated phone lines in multiple languages, catering to XTB’s diverse international clientele.

- Email Support: For more detailed inquiries or issues that require thorough documentation, XTB provides email support with a promise of timely responses.

-

Response Times:

- XTB is committed to maintaining quick response times. Live chat and phone inquiries are typically addressed within a few minutes, while emails are answered within one business day, ensuring that traders are not left waiting during critical trading times.

-

Multilingual Support:

- Reflecting its global presence, XTB offers customer support in various languages, including English, Spanish, Chinese, Arabic, and more. This multilingual support ensures that traders from different regions can receive assistance in their preferred language, making communication clear and effective.

-

Educational Support:

- Besides direct customer service, XTB places a strong emphasis on trader education. The broker provides a comprehensive educational suite that includes webinars, seminars, trading courses, and detailed market analysis. These resources are designed to help traders make informed decisions and enhance their trading skills.

-

Availability:

- Customer support services at XTB are available 24 hours a day, five days a week, covering all trading sessions around the world. This ensures that traders can receive assistance whenever the markets are open.

Prohibited Countries: Where Can I Not Trade with this Broker?

XTB operates globally but, due to regulatory and legal restrictions, there are certain countries and regions where its services are not available. Understanding these limitations is important for traders who might be affected. Here is a detailed overview of where XTB’s trading services are prohibited:

-

Regulatory Restrictions:

- XTB adheres to international laws and regulations which dictate its operations in various countries. Due to stringent financial regulations or the lack of a legal framework for forex and CFD trading in certain regions, XTB cannot offer its services.

-

List of Prohibited Countries:

- As of now, XTB does not provide services to residents of certain countries including the USA, Canada, Iran, Syria, North Korea, and a few others. The specific list of prohibited countries can change based on updates in international law and XTB’s own regulatory compliance policies.

-

Reasons for Restrictions:

- The primary reasons for these geographical restrictions include local financial regulations, potential legal and political risks, and international economic sanctions. These factors can affect the stability and legality of trading operations.

-

Impact on Traders:

- Traders residing in or holding citizenship of these prohibited countries cannot open accounts with XTB. It is important for potential clients to check the most current list directly from XTB’s official website or by contacting their customer support to ensure compliance.

-

Navigating Restrictions:

- For traders affected by these restrictions, it is advisable to seek other reputable brokers that are legally authorized to operate within their respective jurisdictions. Always ensure that any broker considered complies with the relevant local and international regulations to safeguard investments.

Special Offers for Customers

XTB values its clients and frequently introduces various promotions and special offers to enhance their trading experience and reward their loyalty. Here’s an overview of the types of incentives that traders can expect from XTB:

-

Welcome Bonuses:

- XTB occasionally offers welcome bonuses for new clients who open an account and meet specific initial deposit requirements. These bonuses are designed to give new traders a head start by providing additional trading capital.

-

Referral Program:

- XTB encourages its clients to refer new traders to the platform through a referral program. Both the referrer and the new client typically receive a bonus once the new client has met certain trading activity criteria. This program aims to expand XTB’s client base while rewarding existing clients for their endorsements.

-

Loyalty Rewards:

- For its most active traders, XTB offers a loyalty program that rewards points based on trading volume. These points can be redeemed for various benefits, such as lower spreads, commission rebates, or even physical gifts depending on the accumulated points.

-

Educational Events:

- XTB invests in trader education by hosting frequent webinars and seminars. While these are not financial promotions per se, they provide significant value by enhancing traders’ knowledge and skills, which can lead to more informed and potentially more profitable trading.

-

Seasonal Promotions:

- Traders should also keep an eye out for seasonal promotions around significant events or during certain times of the year, such as holiday seasons or major economic announcements. These promotions might include enhanced trading conditions, reduced spreads, or special contests with attractive prizes.

XTB Broker Review Review Conclusion: Reputable Broker with Easy-to-use Platform

XTB has established itself as a reputable broker in the financial trading industry, offering a wide array of services and features that cater to a diverse range of traders. With over two decades of experience, XTB combines technological innovation, comprehensive regulatory compliance, and a strong focus on customer satisfaction to provide a robust trading environment. Here is a summary of XTB’s key strengths and its overall performance as a broker:

-

Technological Excellence: XTB’s trading platform, xStation 5, stands out for its user-friendliness, advanced features, and fast execution speeds. It is designed to accommodate both novice and experienced traders, offering powerful analytical tools, real-time data, and customizable options that enhance the trading experience.

-

Regulatory Rigor: As a broker regulated by several top-tier authorities, including the FCA and CySEC, XTB provides traders with the assurance of safety, security, and transparency in all trading activities. This regulatory framework ensures that client interests are protected and that the broker operates to the highest standards of financial integrity.

-

Diverse Trading Instruments: With access to over 2100 financial instruments across various asset classes, XTB allows traders to diversify their investment portfolios and explore opportunities in different markets, including Forex, stocks, commodities, and cryptocurrencies.

-

Educational and Supportive Services: XTB is committed to trader education and ongoing support. Through its comprehensive educational resources and responsive customer service, XTB empowers traders to develop their skills, make informed decisions, and optimize their trading strategies.

-

Client-Centric Initiatives: The variety of account types, competitive trading conditions, and special promotional offers reflect XTB’s dedication to meeting the needs and preferences of its clients. These initiatives are geared towards enhancing client engagement and satisfaction.

Summary and Key Takeaways

XTB is more than just a platform for trading; it is a partner in the financial markets. The broker’s commitment to technological advancement, educational support, and regulatory adherence makes it a preferred choice for traders looking for a reliable and efficient trading experience. Whether you are a beginner looking to enter the markets or an experienced trader seeking advanced tools and resources, XTB provides a conducive environment for all trading activities.

XTB’s reputation, ease of use, and comprehensive offerings make it a commendable choice for traders aiming to navigate the complexities of the financial markets confidently and successfully.

- Innovative Trading Platform: XTB’s xStation 5 is renowned for its intuitive design, speedy execution, and comprehensive tools, making it suitable for traders at all levels of experience.

- Regulatory Assurance: With stringent regulation by reputable authorities such as the FCA and CySEC, XTB ensures a secure and transparent trading environment, instilling confidence among its clients.

- Diverse Market Opportunities: XTB offers a wide variety of over 2100 financial instruments, allowing traders to diversify their portfolios across Forex, CFDs, stocks, and cryptocurrencies.

- Educational Resources: XTB places a significant emphasis on education and continuous learning, providing numerous resources to help traders improve their trading skills and knowledge.

- Responsive Customer Support: The broker offers multilingual support and fast response times, ensuring that traders’ queries and issues are addressed promptly and effectively.

FAQs

What is XTB and what services does it offer?

XTB is a global trading broker established in 2002, offering access to a variety of financial instruments including Forex, CFDs, stocks, commodities, and cryptocurrencies. Known for its cutting-edge trading platform, xStation 5, XTB provides comprehensive tools for technical analysis, a wealth of educational resources, and robust customer support, ensuring a superior trading experience for both novice and seasoned traders.

What regulatory authorities oversee XTB?

XTB is regulated by several of the world’s leading financial authorities, including the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). These regulations ensure that XTB adheres to stringent standards of financial integrity and transparency, offering a secure trading environment for its clients.

What is the minimum deposit required to open an XTB account?

The minimum deposit required to start trading with XTB is typically around $250. This amount may vary slightly depending on the trader’s region and the specific account type they choose to open.

What is the maximum leverage offered by XTB?

XTB offers maximum leverage of up to 30:1 for retail clients within the EU and UK, with possibilities for higher leverage for professional clients under certain conditions. The leverage levels are subject to regulatory constraints and may vary based on the traded instruments and client eligibility.

How does XTB ensure the security of client funds?

XTB ensures the security of client funds through stringent regulatory compliance, including keeping client funds in segregated accounts separate from the company’s operational funds. This segregation protects clients’ funds from being used for any other purpose. Additionally, XTB offers negative balance protection, ensuring that clients cannot lose more than their initial investment.

Does XTB offer educational resources for traders?

Yes, XTB offers a wide range of educational resources, including webinars, seminars, and online trading courses, covering various aspects of trading and financial markets. These resources are designed to support traders of all levels, enhancing their trading knowledge and skills.

About Author

Robert J. Williams

Robert J. Williams, a finance graduate from the London School of Economics, dove into finance clubs during her studies, honing her skills in portfolio management and risk analysis. With a career spanning prestigious firms like Barclays and HSBC, she's become an authority in asset allocation and investment strategy, known for her insightful reports.User Reviews

Be the first to review “XTB Broker Review: Comprehensive Insights into Services and Features” Cancel reply

- XTB Broker Review Overviews

- Pros and Cons

- Is XTB Broker Review Safe? Broker Regulations

- What Can I Trade with XTB Broker Review?

- How to Trade with XTB Broker Review?

- How Can I Open XTB Broker Review Account? A Simple Tutorial

- XTB Broker Review Charts and Analysis

- XTB Broker Review Account Types

- Do I Have Negative Balance Protection with This Broker?

- XTB Broker Review Deposits and Withdrawals

- Support Service for Customer

- Prohibited Countries: Where Can I Not Trade with this Broker?

- Special Offers for Customers

- XTB Broker Review Review Conclusion: Reputable Broker with Easy-to-use Platform

- Summary and Key Takeaways

- FAQs

- About Author

There are no reviews yet.