OCTA Broker Review: A Global Leader in Forex and CFD Trading

OCTA Overviews

OCTA Broker has emerged as a significant player in the trading industry since its establishment in 2011, boasting a widely comprehensive suite of financial services to its global clientele. Its head office is found in London, and through steady expansion, it now serves millions of traders from over 180 countries. Its commitment to innovative and reliable trading solutions makes it a trusted partner for traders around the world.

OCTA Broker offers diverse financial instruments, such as currency pairs, commodities, indices, and cryptocurrencies, to form well-diversified portfolios. Such a large number becomes an opportunity for most types of market participants with different interests and strategies. Second, the broker provides access to advanced trading platforms, namely MetaTrader 4 and MetaTrader 5, as well as the proprietary OctaTrader platform. Each platform is provided with an intuitive interface and a set of analytical tools, which give a chance to traders to take trading decisions and therefore maximize the process of trading.

OCTA Broker attracts even new, inexperienced traders with its absolutely competitive trading conditions: starting spreads from 0.6 pips, zero commissions, and options for leverage up to 1: 1000. Such favorable conditions provide such pliability and cost-effectiveness that the traders are able to realize their maximum potential on the markets. The company does not stop at trading conditions; it focuses on client education through an extensive library of resources: webinars, tutorials, and market analyses, keeping the client informed of all the information needed for success.

In the last few years, OCTA Broker has successfully received over 70 very prestigious industry awards, proving their commitment to excellence. The awards thus reflect their relentless service to meet up the needs of customers by upholding high standards in the financial services sector. The broker also stresses security through measures as data encryption, separate accounts of customers, and negative balance protection in ensuring that funds and private information are guaranteed safe and secure. In the negative aspect, it prevents the loss of money more than deposited to traders.

OCTA Broker has outgrew, one of the most prominent players in the international financial arena, boasting customers across millions in the world, owing to its broad product spectrum, fast technology, and high safety and customer satisfaction guaranteeing commitments.

- OCTA Broker was established in 2011 and is headquartered in Nicosia, Cyprus.

- It operates in over 180 countries and manages more than 52 million trading accounts.

- The broker offers a wide range of trading instruments, including forex, commodities, indices, and cryptocurrencies.

- OCTA Broker’s proprietary platform, OctaTrader, integrates trading, analysis, and financial transactions into one application.

- It has won several awards, including the 'Most Reliable Broker – Global' award in 2024 from the Global Forex Awards.

- Transparency and customer satisfaction are key priorities for the broker, solidifying its reputation.

- With over 1,300 employees, OCTA Broker continues to innovate and adapt to traders' needs.

- The broker emphasizes education and research to help clients enhance their trading skills.

- Its global reach and customer-focused approach have made OCTA Broker a leading player in the financial trading sector.

Pros and Cons

- Competitive Spreads: OCTA Broker provides tight forex spreads, enhancing cost-efficiency for traders.

- Diverse Trading Platforms: The broker supports multiple platforms, including MetaTrader 4, MetaTrader 5, and its proprietary OctaTrader, accommodating various trading preferences.

- Comprehensive Research Materials: Clients have access to well-organized research, including trading ideas, daily updates, and weekly forecasts, aiding informed decision-making.

- 24/7 Customer Support: OCTA Broker offers round-the-clock customer service, ensuring assistance is available whenever needed.

- No Inactivity or Swap Fees: The broker does not charge inactivity or swap fees, reducing the overall cost of trading.

- Limited Range of Tradeable Instruments: OCTA Broker offers a smaller selection of tradeable symbols compared to some competitors, which may limit diversification opportunities.

- Regulatory Coverage: While regulated in certain jurisdictions, OCTA Broker lacks regulation from major financial authorities like the FCA or ASIC, which may be a concern for some traders.

- Mobile Copy Trading Limited to Android: The broker's mobile copy trading feature is currently available only for Android users, potentially limiting accessibility for iOS users.

- Limited Cryptocurrency Offerings: OCTA Broker provides a limited number of cryptocurrency pairs, which may not meet the needs of traders interested in a broader range of digital assets.

Is OCTA Safe? Broker Regulations

OCTA Broker operates under multiple regulatory frameworks, ensuring a secure trading environment for its clients. The broker is authorized and regulated by the following authorities:

- Cyprus Securities and Exchange Commission (CySEC): OCTA Broker holds a license from CySEC, which enforces compliance with the European Union’s Markets in Financial Instruments Directive (MiFID II), enhancing transparency and investor protection.

- Financial Sector Conduct Authority (FSCA) of South Africa: The broker is authorized by the FSCA, ensuring adherence to local financial regulations and promoting fair market practices.

- Ministry of Information, Communication & The Digital Economy (MISA) in the Comoros: OCTA Broker operates under MISA’s jurisdiction, providing regulatory oversight within the Comoros.

In addition to regulatory compliance, OCTA Broker implements several security measures to protect client funds and personal information:

- Segregated Accounts: Client funds are held in segregated accounts, separate from the company’s operational funds, ensuring that client assets are protected even in the event of the company’s insolvency.

- Negative Balance Protection: The broker offers negative balance protection, preventing clients from losing more than their account balance, which is crucial during periods of high market volatility.

- Advanced Security Protocols: OCTA Broker employs Secure Sockets Layer (SSL) technology with 128-bit encryption to safeguard personal data and online financial transactions, ensuring that client information remains confidential and secure.

These regulatory affiliations and security measures demonstrate OCTA Broker’s commitment to providing a safe and transparent trading environment for its clients.

- Cyprus Securities and Exchange Commission (CySEC)

- Financial Sector Conduct Authority (FSCA)

- Ministry of Information, Communication & The Digital Economy (MISA)

What Can I Trade with OCTA?

OCTA Broker offers a diverse range of trading instruments across multiple asset classes, catering to various trading preferences and strategies. Below is an overview of the available markets:

- Forex: OCTA Broker provides access to 52 currency pairs, including major, minor, and exotic pairs, allowing traders to participate in the global foreign exchange market.

- Metals: Traders can engage in trading precious metals such as gold and silver, which are popular for hedging and diversification purposes.

- Energies: The broker offers trading opportunities in energy commodities, including crude oil and natural gas, enabling traders to capitalize on price movements in these vital markets.

- Indices: OCTA Broker provides access to 10 major global stock indices, such as the Dow Jones Industrial Average (US30), NASDAQ 100 (NAS100), and FTSE 100 (UK100), allowing traders to speculate on the performance of broader markets.

- Cryptocurrencies: The broker offers 34 cryptocurrency pairs, including popular digital assets like Bitcoin, Ethereum, and Litecoin, catering to traders interested in the volatile and rapidly evolving crypto market.

- Stocks: Through Contracts for Difference (CFDs), traders can access over 150 stocks from various global exchanges, enabling speculation on individual company performance without owning the underlying assets.

This extensive selection of trading instruments allows OCTA Broker’s clients to diversify their portfolios and implement various trading strategies across different markets.

- Forex

- Metals

- Energies

- Indices

- Cryptocurrencies

- Stocks

How to Trade with OCTA?

Trading with OCTA Broker is a streamlined process designed to accommodate both novice and experienced traders. Below is a step-by-step guide to navigating the trading process:

- Platform Access:

- Web Platform: Log in to your OCTA Broker account through the official website. Once logged in, access the trading platform directly from your dashboard.

- Mobile Application: Download the OctaTrader app, available for both Android and iOS devices. Use your account credentials to log in and access trading features on the go.

- Account Funding:

- Deposit Funds: Navigate to the ‘Deposit’ section in your account dashboard. Choose your preferred payment method, such as bank transfer, credit/debit card, or e-wallets. Enter the deposit amount and follow the prompts to complete the transaction.

- Market Selection:

- Instrument Choice: Within the trading platform, access the ‘Market Watch’ panel to view available instruments, including forex pairs, commodities, indices, and cryptocurrencies. Select the asset you wish to trade.

- Placing a Trade:

- Order Placement: Click on the chosen instrument to open the order window. Specify the trade parameters, including volume (lot size), stop loss, and take profit levels. Choose the order type—market execution for immediate orders or pending orders for future execution at specified price levels. Confirm the order to execute the trade.

- Monitoring and Managing Trades:

- Open Positions: Access the ‘Trade’ tab to monitor active positions. Here, you can view real-time profit/loss, modify stop loss and take profit levels, or close positions as needed.

- Utilizing Trading Tools:

- Charting Tools: OCTA Broker provides advanced charting features with multiple timeframes, technical indicators, and drawing tools to assist in market analysis.

- Economic Calendar: Stay informed about upcoming economic events and news releases that may impact market movements.

- Withdrawing Funds:

- Withdrawal Process: To withdraw funds, go to the ‘Withdrawal’ section in your account dashboard. Select the withdrawal method, enter the amount, and submit the request. Processing times may vary depending on the chosen method.

By following these steps, traders can effectively navigate the OCTA Broker platform, execute trades, and manage their accounts efficiently.

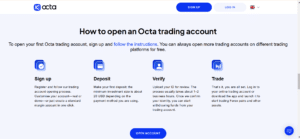

How Can I Open OCTA Account? A Simple Tutorial

Opening an account with OCTA Broker is a straightforward process designed to accommodate both novice and experienced traders. Follow the steps below to set up your account:

- Registration:

- Visit the Official Website: Navigate to the OCTA Broker homepage.

- Initiate Sign-Up: Click on the ‘Open Account’ or ‘Sign Up’ button prominently displayed on the website.

- Provide Personal Information: Fill in the registration form with your full name, valid email address, and a secure password. Alternatively, you can sign up using your Facebook, Google, or Apple ID for convenience.

- Agree to Terms: Review and accept the terms and conditions, privacy policy, and any other relevant agreements.

- Email Confirmation:

- Check Your Inbox: After registration, OCTA Broker will send a confirmation email to the address provided.

- Verify Email: Open the email and click on the confirmation link to verify your email address.

- Personal Details:

- Complete Profile: Log in to your OCTA Broker account and provide additional personal information, including your country of residence, phone number, and date of birth.

- Experience Level: Indicate your trading experience to help OCTA Broker tailor its services to your needs.

- Account Configuration:

- Choose Account Type: Select between a Real or Demo account. A Demo account is recommended for beginners to practice trading without financial risk.

- Select Trading Platform: Choose from MetaTrader 4, MetaTrader 5, or OctaTrader, depending on your trading preferences.

- Set Leverage: Determine your preferred leverage ratio, keeping in mind that higher leverage increases both potential profits and risks.

- Verification:

- Identity Verification: Upload a clear copy of a government-issued ID, such as a passport or driver’s license, to verify your identity.

- Address Verification: Provide a recent utility bill or bank statement displaying your name and address to confirm your residence.

- Processing Time: Verification typically takes 1–2 business hours.

- Funding Your Account:

- Deposit Funds: Once verified, navigate to the ‘Deposit’ section in your account dashboard.

- Select Payment Method: Choose from various options, including bank transfers, credit/debit cards, or e-wallets.

- Enter Deposit Amount: Specify the amount you wish to deposit, adhering to any minimum deposit requirements.

- Confirm Transaction: Follow the prompts to complete the deposit process.

- Start Trading:

- Access Trading Platform: Download and install your chosen trading platform or use the web-based version.

- Log In: Use the credentials provided to access your trading account.

- Begin Trading: Explore the platform’s features, analyze markets, and start placing trades.

By following these steps, you can efficiently set up and begin trading with OCTA Broker. Ensure all information provided is accurate to facilitate a smooth verification process.

- Visit Website and Register: Go to OCTA Broker's homepage and click "Open Account" or "Sign Up." Provide your full name, email, and password or sign up via Facebook, Google, or Apple ID.

- Agree to Terms: Accept the terms and conditions, privacy policy, and other agreements to complete the registration process.

- Email Confirmation: Check your email for a confirmation link and verify your email address.

- Complete Your Profile: Log in to your account and provide personal details, including your country, phone number, and date of birth. Indicate your trading experience.

- Choose Account Settings: Select a Real or Demo account, pick your preferred trading platform (MetaTrader 4, MetaTrader 5, or OctaTrader), and set your desired leverage ratio.

- Verify Your Identity: Upload a government-issued ID and proof of address (utility bill or bank statement) for verification, which usually takes 1–2 business hours.

- Fund Your Account: Navigate to the 'Deposit' section, choose a payment method, specify the amount, and confirm the deposit.

- Access and Start Trading: Download or use the web-based trading platform, log in with your credentials, and start trading.

- Ensure Accuracy: Provide accurate information during registration and verification to avoid delays in setting up your account.

OCTA Charts and Analysis

OCTA Broker equips traders with a suite of charting tools and analytical resources to facilitate informed decision-making across various trading styles.

Charting Tools:

- Advanced Charting: OCTA Broker’s platforms, including MetaTrader 4, MetaTrader 5, and the proprietary OctaTrader, offer advanced charting capabilities. Traders can access multiple chart types, such as line, bar, and candlestick charts, across various timeframes to suit different analytical needs.

- Technical Indicators: A comprehensive selection of technical indicators is available, including moving averages, Bollinger Bands, and Relative Strength Index (RSI). These tools assist traders in identifying trends, momentum, and potential reversal points.

- Drawing Tools: Traders can utilize drawing tools like trend lines, Fibonacci retracements, and support and resistance levels to perform detailed technical analysis directly on the charts.

Analytical Resources:

- Autochartist Integration: OCTA Broker has partnered with Autochartist to provide automated chart pattern recognition. This tool scans the markets for trading opportunities, identifying patterns such as triangles, wedges, and head and shoulders formations, thereby saving traders time in manual analysis.

- Economic Calendar: An integrated economic calendar keeps traders informed about upcoming economic events and news releases that could impact market movements. This feature is essential for fundamental analysis and planning trades around significant events.

- Market News and Analysis: OCTA Broker provides regular market updates, including daily and weekly analyses, to help traders stay abreast of market trends and developments. These insights are valuable for both short-term and long-term trading strategies.

Usability for Different Trading Styles:

- Beginners: The user-friendly interface of OctaTrader, combined with educational resources and demo accounts, makes it accessible for novice traders to learn and practice trading strategies.

- Intermediate Traders: The availability of a wide range of technical indicators and analytical tools supports intermediate traders in refining their strategies and improving their market analysis skills.

- Advanced Traders: For seasoned traders, the integration of Autochartist and the advanced features of MetaTrader platforms, such as algorithmic trading and custom indicators, provide a robust environment for sophisticated trading strategies.

In summary, OCTA Broker’s comprehensive charting tools and analytical resources cater to a wide spectrum of traders, enhancing their ability to analyze markets effectively and execute informed trading decisions

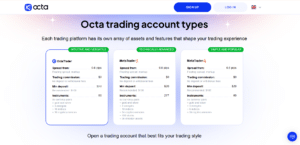

OCTA Account Types

OCTA Broker offers a variety of account types to cater to different trading preferences and experience levels. Below is a comparison of the available accounts:

| Account Type | Minimum Deposit | Spread Type | Average Spread (EUR/USD) | Commission | Leverage | Instruments Available | Platform | Features |

| OctaTrader | $25 | Floating | From 0.6 pips | None | Up to 1:1000 | 80 instruments including 35 currency pairs, gold & silver, 3 energies, 10 indices, 30 cryptocurrencies | OctaTrader | User-friendly interface, suitable for beginners |

| MetaTrader 4 | $25 | Floating | From 0.6 pips | None | Up to 1:1000 | 80 instruments including 35 currency pairs, gold & silver, 3 energies, 6 indices, 34 cryptocurrencies | MetaTrader 4 | Supports Expert Advisors (EAs), widely used platform |

| MetaTrader 5 | $25 | Floating | From 0.6 pips | None | Up to 1:1000 | 277 instruments including 52 currency pairs, gold & silver, 3 energies, 10 indices, 34 cryptocurrencies, 150 stocks, 26 intraday assets | MetaTrader 5 | Advanced features, supports hedging and netting |

Each account type is designed to provide traders with flexibility and access to a wide range of financial instruments, ensuring a tailored trading experience.

Do I Have Negative Balance Protection with This Broker?

cannot lose more than their initial deposit. This feature is crucial, especially during periods of high market volatility, as it prevents clients from incurring debts beyond their account balance.

How Negative Balance Protection Works:

- Automatic Adjustment: If a client’s account balance becomes negative due to market fluctuations or stop-out events, OCTA Broker automatically adjusts the balance back to zero.

- Risk Limitation: This mechanism ensures that a trader’s risk is limited to the funds deposited in their account, providing a safety net against unforeseen market movements.

Impact on Trader Risk Management:

- Enhanced Security: Negative balance protection offers traders peace of mind, knowing they are shielded from losses exceeding their deposits.

- Encourages Responsible Trading: While this protection is beneficial, traders are still encouraged to employ prudent risk management strategies, such as setting stop-loss orders and using leverage responsibly.

In summary, OCTA Broker’s negative balance protection is a vital feature that safeguards clients from excessive losses, reinforcing the broker’s commitment to providing a secure trading environment.

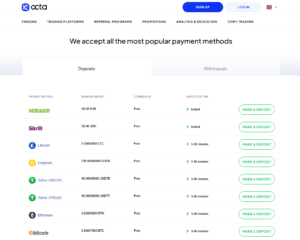

OCTA Deposits and Withdrawals

OCTA Broker offers a variety of deposit and withdrawal methods to accommodate the diverse needs of its clients. Below is an overview of the available options, including minimum transaction amounts, associated fees, and processing times.

Deposit Methods:

| Method | Minimum Deposit | Fees | Processing Time |

| Bank Transfer | $50 | None | 3–7 business days |

| Credit/Debit Card | $50 | None | Instant |

| E-wallets (e.g., Skrill, Neteller) | $5 | None | Instant |

| Local Bank Transfer | $5 | None | 1–3 hours |

Note: Processing times may vary depending on the specific payment provider and the client’s country of residence.

Withdrawal Methods:

| Method | Minimum Withdrawal | Fees | Processing Time |

| Bank Transfer | $10 | None | 1–3 hours to approve; up to 1 hour to transfer funds |

| Credit/Debit Card | $20 (Visa), $50 (MasterCard) | None | 1–3 hours to approve; up to 1 hour to transfer funds |

| E-wallets (e.g., Skrill, Neteller) | $5 | None | 1–3 hours to approve; up to 5 minutes to transfer funds |

| Cryptocurrencies (e.g., Bitcoin, Litecoin) | Varies by currency | None | 1–3 hours to approve; up to 30 minutes to transfer funds |

Note: While OCTA Broker does not charge fees for deposits or withdrawals, third-party charges (e.g., bank fees, blockchain fees) may apply.

Additional Information:

- Currency Conversion: If deposits or withdrawals are made in a currency different from the account’s base currency, currency conversion fees may apply.

- Verification: Clients must complete the account verification process before initiating withdrawals. This process typically involves submitting identification documents and proof of address.

- Processing Times: OCTA Broker aims to process withdrawal requests within 1–3 hours. However, the total time for funds to reach the client’s account depends on the chosen payment method and the processing times of the respective financial institutions.

By offering a range of deposit and withdrawal options with no internal fees, OCTA Broker provides clients with flexibility and convenience in managing their trading funds.

Support Service for Customer

OCTA Broker is committed to providing comprehensive customer support to assist clients with their trading needs. The broker offers multiple channels for customer service, ensuring accessibility and prompt assistance.

Customer Support Channels:

- Live Chat: Available 24/7, the live chat feature allows clients to connect with support representatives in real-time for immediate assistance.

- Email Support: Clients can reach out via email at [email protected] for inquiries that may not require instant responses. The support team typically responds within a few hours.

- Social Media: OCTA Broker maintains an active presence on various social media platforms, providing additional avenues for support and updates.

Availability and Languages Supported:

Customer support is available 24 hours a day, seven days a week, ensuring that clients can receive assistance at any time, regardless of their time zone. The support team is proficient in multiple languages, including English, Indonesian, Malay, Thai, Hindi, and Urdu, catering to a diverse global clientele.

Response Times and Quality:

OCTA Broker is recognized for its prompt and efficient customer service. Live chat responses are typically provided within 30 seconds, and email inquiries are addressed within a few hours. The support team is knowledgeable and strives to resolve issues effectively, contributing to a high satisfaction rate among clients.

In summary, OCTA Broker’s customer support services are designed to be accessible, responsive, and multilingual, ensuring that clients receive the necessary assistance promptly and effectively.

Prohibited Countries: Where Can I Not Trade with this Broker?

OCTA Broker operates under various regulatory frameworks, which necessitate restrictions on providing services to residents of certain countries. As of the latest available information, OCTA Broker does not offer its services to citizens or residents of the following countries:

- United States of America

- United Kingdom

- Iceland

- Liechtenstein

- Norway

- Russia

- Cyprus

- Belarus

- Kazakhstan

- Ukraine

- Puerto Rico

- Philippines

These restrictions are primarily due to regulatory requirements and compliance with international financial laws. For instance, OCTA Broker explicitly states that it does not provide services to citizens or residents of the United States, the United Kingdom, Iceland, Liechtenstein, Norway, and the Philippines.

Additionally, recent developments have led to OCTA Broker being placed on alert lists in certain jurisdictions. In October 2023, Indian authorities included OCTA Broker among several international brokers operating in India without proper authorization. This action underscores the importance of traders ensuring that their broker is authorized to operate in their specific country of residence.

It’s crucial for potential clients to verify the availability of OCTA Broker’s services in their respective countries before attempting to open an account. This due diligence helps ensure compliance with local regulations and the legality of trading activities.

Special Offers for Customers

OCTA Broker provides a variety of promotions and loyalty programs designed to enhance the trading experience and reward client engagement. Below are some of the notable offers available to customers:

- 50% Deposit Bonus:

Clients can receive a 50% bonus on each deposit, effectively increasing their trading capital. For example, a deposit of $200 would result in an additional $100 bonus, totaling $300 in trading funds. To withdraw the bonus, traders are required to trade a certain number of lots, calculated as the bonus amount divided by two. This promotion is available for each deposit, not just the first one.

- Trade and Win Loyalty Program:

This program allows traders to accumulate prize lots based on their trading activity, which can be redeemed for various gifts, including gadgets and merchandise. The accumulation rate of prize lots increases with the client’s status level:

- Silver Status: 1 traded lot equals 1.1 prize lots.

- Gold Status: 1 traded lot equals 1.25 prize lots.

- Platinum Status: 1 traded lot equals 1.5 prize lots.

The list of available gifts may vary depending on the client’s region and active status in the program.

- Status Program:

OCTA Broker offers a tiered status program that provides additional benefits as clients progress through different levels:

- Bronze: Commission-free transfers and 24/7 customer support.

- Silver: Includes trading signals by Autochartist.

- Gold: Offers accelerated transfers, lower spreads, and faster bonus withdrawals.

- Platinum: Provides VIP events, a personal manager, and expert advice.

Clients can upgrade their status by maintaining higher account balances and increasing their trading activity.

- Zero-Fee Deposits and Withdrawals:

OCTA Broker covers all charges for deposits and withdrawals, ensuring that clients can transfer funds without incurring additional costs. This benefit is available on higher status levels within the status program.

- Special Promotions:

Occasionally, OCTA Broker offers special promotions, such as a 100% deposit bonus during certain events, allowing clients to double their deposit amount. These promotions are typically time-limited and may have specific terms and conditions.

Clients are encouraged to regularly check OCTA Broker’s official website or contact customer support to stay informed about the latest promotions and to understand the terms and conditions associated with each offer.

OCTA Review Conclusion: Reputable Broker with Easy-to-use Platform

OCTA Broker, established in 2011, has garnered a solid reputation in the trading community by offering a user-friendly platform and a range of services tailored to both novice and experienced traders.

Strengths:

- Regulatory Compliance: OCTA Broker operates under multiple regulatory authorities, including the Cyprus Securities and Exchange Commission (CySEC) and the Financial Sector Conduct Authority (FSCA) of South Africa, ensuring adherence to international financial standards.

- Diverse Trading Instruments: The broker provides access to a wide array of financial instruments, including forex pairs, commodities, indices, and cryptocurrencies, allowing traders to diversify their portfolios effectively.

- Competitive Trading Conditions: With tight spreads, zero commissions, and high leverage options up to 1:1000, OCTA Broker offers favorable trading conditions that appeal to various trading strategies.

- Educational Resources: The broker offers comprehensive educational materials, including webinars, tutorials, and market analysis, supporting traders in making informed decisions.

Areas for Improvement:

- Limited Asset Range: While offering a broad spectrum of instruments, the total number of tradeable assets is relatively limited compared to some industry leaders.

- Geographical Restrictions: OCTA Broker’s services are not available in certain countries, which may limit accessibility for some potential clients.

Conclusion:

OCTA Broker stands out as a reputable broker with an easy-to-use platform, making it suitable for traders at all levels. Its commitment to regulatory compliance, competitive trading conditions, and robust customer support underscores its dedication to providing a secure and efficient trading environment. However, potential clients should consider the broker’s geographical limitations and assess whether the available range of instruments aligns with their trading objectives.

Summary and Key Takeaways

OCTA Broker, established in 2011, has positioned itself as a reputable trading platform offering a range of services tailored to both novice and experienced traders. Operating under multiple regulatory authorities, including the Cyprus Securities and Exchange Commission (CySEC) and the Financial Sector Conduct Authority (FSCA) of South Africa, OCTA Broker ensures adherence to international financial standards.

In conclusion, OCTA Broker stands out as a reputable broker with an easy-to-use platform, making it suitable for traders at all levels. Its commitment to regulatory compliance, competitive trading conditions, and robust customer support underscores its dedication to providing a secure and efficient trading environment. However, potential clients should consider the broker’s geographical limitations and assess whether the available range of instruments aligns with their trading objectives.

- Diverse Trading Instruments: OCTA Broker provides access to a wide array of financial instruments, including forex pairs, commodities, indices, and cryptocurrencies, allowing traders to diversify their portfolios effectively.

- Competitive Trading Conditions: With tight spreads, zero commissions, and high leverage options up to 1:1000, OCTA Broker offers favorable trading conditions that appeal to various trading strategies.

- Educational Resources: The broker offers comprehensive educational materials, including webinars, tutorials, and market analysis, supporting traders in making informed decisions.

- Limited Asset Range: While offering a broad spectrum of instruments, the total number of tradeable assets is relatively limited compared to some industry leaders.

- Geographical Restrictions: OCTA Broker's services are not available in certain countries, which may limit accessibility for some potential clients.

FAQs

What trading platforms does Octa FX offer?

Octa FX provides popular trading platforms including MetaTrader 4, MetaTrader 5, and cTrader. These platforms are available on desktop, web, and mobile apps, catering to all types of traders with their intuitive interfaces and robust trading tools.

What types of accounts can I open with Octa FX?

Octa FX offers several account types to suit various trading strategies and levels of experience, including Micro, Pro, and ECN accounts. Each type offers different benefits such as lower spreads, higher leverage, and more instrument availability.

Is Octa FX regulated?

Yes, Octa FX is regulated by the Cyprus Securities and Exchange Commission (CySEC), ensuring compliance with financial standards and providing traders with a secure trading environment.

Does Octa FX offer any educational resources?

Octa FX is committed to educating traders, offering a range of educational materials including articles, tutorials, webinars, and trading strategies designed for both beginners and experienced traders.

What are the deposit and withdrawal options at Octa FX?

Octa FX supports multiple deposit and withdrawal methods, including bank wire transfers, credit cards, and e-wallets like Skrill and Neteller. The broker also supports local bank transfers in certain regions, making transactions more accessible for traders worldwide.

About Author

Alexandra Winters

Alexandra Winters is a highly accomplished finance specialist with a proven track record of success in the industry. Born and raised in the United States, Alexandra's passion for finance and trading led her to pursue a Bachelor's degree in Finance and Economics from the prestigious Wharton School of the University of Pennsylvania. After graduating, Alexandra launched her career as a financial analyst at J.P. Morgan in New York City, quickly establishing herself as a top performer. She then transitioned to a role as a derivatives trader at Morgan Stanley, where she specialized in trading complex financial instruments and consistently generated strong ...User Reviews

Be the first to review “OCTA Broker Review: A Global Leader in Forex and CFD Trading” Cancel reply

- OCTA Overviews

- Pros and Cons

- Is OCTA Safe? Broker Regulations

- What Can I Trade with OCTA?

- How to Trade with OCTA?

- How Can I Open OCTA Account? A Simple Tutorial

- OCTA Charts and Analysis

- OCTA Account Types

- Do I Have Negative Balance Protection with This Broker?

- OCTA Deposits and Withdrawals

- Support Service for Customer

- Prohibited Countries: Where Can I Not Trade with this Broker?

- Special Offers for Customers

- OCTA Review Conclusion: Reputable Broker with Easy-to-use Platform

- Summary and Key Takeaways

- FAQs

- About Author

There are no reviews yet.