InstaForex Review: Versatile Trading and Investment Opportunities

InstaForex Overviews

InstaForex, established in 2007, offers a range of trading services on Forex, including spot trading and CFDs on stocks, cryptocurrencies, and commodities. The broker is known for its diverse account options, high leverage up to 1:1000, and innovative investment services like PAMM and ForexCopy systems. InstaForex also provides a robust suite of trading tools, educational materials, and regular contests with significant prizes, emphasizing its commitment to trader development and community engagement.

InstaForex is a broker company that was registered in 2007 and has its headquarters in Kaliningrad, Russia. Its services have been particularly renowned for providing not only financial services but also competitive conditions for trading, including various types of profiles-from the most novice to high-tier investors. In doing so, it remains innovative with more than 300 available instruments for trading: forex, stocks, commodities, cryptocurrencies, and other assets. Its unique features include a solid set of trading tools, educational resources, and a number of other social trading options from which users can learn from and mirror experienced traders.

In its presence on the financial market, InstaForex won numerous awards. The “Best Broker in Asia” prize of the International Finance Awards and “Best ECN Broker” according to the UK Forex Awards are among them. Another quality of the company is attention to technology and security, which simplifies making correct trading decisions for their huge global customer base.

Available in many parts of the world, the InstaForex service is most represented in Asia and Eastern Europe. Some regions impose specific rules on how the company runs their business; this fact means that it follows the demands that modern standards and regulation procedures have for the international financial society. InstaForex places the emphasis on friendliness in all aspects of trading and keeps the most extensive and user-friendly set of platforms and the most popular third-party platforms, including MetaTrader 4 and MetaTrader 5.

- Established Player: InstaForex, founded in 2007, serves over 7 million clients globally, showcasing its widespread popularity.

- Global Reach: Operates through 250+ representative offices, with strong presence in Asia, Eastern Europe, Latin America, and Africa.

- Diverse Instruments: Provides access to 300+ trading instruments, including forex, stocks, commodities, and cryptocurrencies.

- Focus on Innovation: Continuously expands services to adapt to the evolving needs of traders and ensure client satisfaction.

Pros and Cons

- Diverse Trading Instruments: Access to over 300 financial instruments, including forex, commodities, indices, stocks, and cryptocurrencies, allowing traders to diversify their portfolios.

- User-Friendly Platforms: Utilizes MetaTrader 4 and MetaTrader 5, known for their intuitive interfaces and advanced trading tools, catering to both beginners and experienced traders.

- Competitive Spreads and Leverage: Offers competitive spreads, with some accounts providing spreads starting from 0.0 pips, and leverage options up to 1:1000, enabling traders to control larger positions with smaller capital investments.

- Multiple Account Types: Provides various account options, including standard, ECN, and cent accounts, accommodating different trading styles and experience levels.

- Extensive Educational Resources: Offers a wide range of educational materials, such as video tutorials, webinars, and trading guides, to help traders enhance their knowledge and skills.

- High Spreads on Certain Accounts: Some account types feature higher spreads, which may not be ideal for cost-conscious traders.

- Limited Customer Support Languages: Customer support is available only in English, Czech, Polish, and Slovak, which may be a limitation for non-speakers of these languages.

- Withdrawal Fees: Certain withdrawal methods may incur fees, which could affect overall trading costs.

- Complex Fee Structure: The fee structure can be intricate, potentially leading to confusion among traders regarding trading costs.

- Outdated Website Interface: The broker’s website and client cabinet may feel outdated and difficult to navigate for newcomers.

Is InstaForex Safe? Broker Regulations

InstaForex operates under the regulatory oversight of multiple financial authorities, ensuring adherence to industry standards and the protection of client interests.

Regulatory Status:

- Cyprus Securities and Exchange Commission (CySEC): Instant Trading EU Ltd, a part of the InstaForex group, is licensed and regulated by CySEC under license number 266/15.

This regulation mandates compliance with the Markets in Financial Instruments Directive (MiFID), ensuring a high level of investor protection and transparency. - British Virgin Islands Financial Services Commission (BVI FSC): InstaFinance Ltd, another entity within the InstaForex group, is authorized and licensed by the BVI FSC under the Securities and Investment Business Act (SIBA), license number SIBA/L/14/1082.

While BVI FSC regulation is considered less stringent compared to CySEC, it still requires adherence to certain financial standards and practices.

Security Measures:

- Segregated Accounts: InstaForex ensures that client funds are held in segregated accounts, separate from the company’s operational funds. This practice safeguards client assets, providing protection in the unlikely event of company insolvency.

- Advanced Encryption: The broker employs robust encryption technologies, including SSL encryption, to secure data transmission and protect clients’ personal and financial information from unauthorized access.

- Two-Factor Authentication (2FA): InstaForex offers two-factor authentication, adding an extra layer of security by requiring secondary verification during login, thereby enhancing account protection against unauthorized access.

- Investor Compensation Fund (ICF): As a CySEC-regulated entity, Instant Trading EU Ltd is a member of the ICF, which serves to protect eligible retail clients by paying compensation in the event that a company fails to reimburse funds and/or financial instruments due to financial issues.

These regulatory affiliations and security measures underscore InstaForex’s commitment to providing a secure and transparent trading environment for its clients.

- Cyprus Securities and Exchange Commission (CySEC)

- British Virgin Islands Financial Services Commission (BVI FSC)

What Can I Trade with InstaForex?

InstaForex offers a diverse range of trading instruments, allowing clients to engage in various financial markets:

- Forex: Trade over 100 currency pairs, including major, minor, and exotic pairs, providing ample opportunities for forex traders.

- Commodities: Access to commodities such as gold, silver, crude oil, and natural gas, enabling traders to diversify their portfolios.

- Indices: Trade major global stock indices, including the S&P 500, FTSE 100, and DAX 30, offering exposure to broader market movements.

- Stocks: Engage in CFD trading on shares of major companies across global markets, allowing speculation on stock price movements without owning the underlying assets.

- Cryptocurrencies: Trade popular cryptocurrencies like Bitcoin, Ethereum, Litecoin, and Ripple, catering to the growing interest in digital assets.

This extensive selection of tradable instruments enables InstaForex clients to implement diverse trading strategies and build varied portfolios.

- Forex

- Commodities

- Indices

- Stocks

- Cryptocurrencies

How to Trade with InstaForex?

Trading with InstaForex involves a series of steps designed to provide a seamless experience for both novice and experienced traders. Here’s a comprehensive guide to navigating the trading process:

- Account Registration:

- Visit the InstaForex Website: Navigate to the official InstaForex website and click on the ‘Open Account’ button.

- Complete the Registration Form: Provide the required personal information, including your full name, email address, phone number, and country of residence.

- Choose Account Parameters: Select your preferred account type, base currency (USD, EUR, etc.), and leverage ratio.

- Agree to Terms: Review and accept the terms and conditions to proceed.

- Account Verification:

- Identity Verification: Upload a valid government-issued ID (e.g., passport or driver’s license) to confirm your identity.

- Address Verification: Provide a recent utility bill or bank statement displaying your name and address to verify your residence.

- Processing Time: Verification typically takes up to 72 hours.

- Funding Your Account:

- Log In to Client Cabinet: Access your account dashboard using your credentials.

- Select Deposit Method: Choose from various options, including bank transfers, credit/debit cards, and e-wallets like Skrill or Neteller.

- Enter Deposit Amount: Specify the amount you wish to deposit, adhering to any minimum deposit requirements.

- Confirm Transaction: Follow the prompts to complete the deposit process.

- Downloading the Trading Platform:

- Choose Platform: InstaForex supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

- Download and Install: Visit the InstaForex website to download the platform compatible with your device (Windows, Mac, iOS, Android).

- Log In: Use your account credentials to access the trading platform.

- Navigating the Trading Platform:

- Familiarize Yourself: Explore the platform’s interface, including charts, market watch, and order windows.

- Customize Settings: Adjust chart types, timeframes, and indicators to suit your trading preferences.

- Placing a Trade:

- Select Instrument: Choose the financial instrument you wish to trade from the market watch list.

- Analyze the Market: Utilize technical and fundamental analysis tools available on the platform.

- Open Order Window: Right-click on the chosen instrument and select ‘New Order.’

- Set Parameters:

- Volume: Specify the lot size.

- Order Type: Choose between ‘Market Execution’ or ‘Pending Order.’

- Stop Loss/Take Profit: Set desired levels to manage risk and secure profits.

- Execute Trade: Click ‘Buy’ or ‘Sell’ to open the position.

- Monitoring and Managing Trades:

- Track Positions: View open trades in the ‘Terminal’ window under the ‘Trade’ tab.

- Modify Orders: Right-click on an open position to adjust stop loss, take profit, or close the trade.

- Review History: Access the ‘Account History’ tab to analyze past trades and performance.

- Withdrawing Funds:

- Initiate Withdrawal: Log in to the Client Cabinet and select ‘Withdraw Funds.’

- Choose Method: Select your preferred withdrawal option, ensuring it matches your deposit method.

- Enter Amount: Specify the withdrawal amount, considering any applicable fees.

- Confirm Request: Submit the request and await processing, which may take up to 24 hours.

By following these steps, traders can effectively navigate the InstaForex platform, from account setup to executing and managing trades.

How Can I Open InstaForex Account? A Simple Tutorial

Opening an account with InstaForex is a straightforward process designed to accommodate both novice and experienced traders. Follow these steps to set up your trading account:

- Visit the InstaForex Website:

- Navigate to the official InstaForex website.

- Initiate the Registration Process:

- Click on the “Open Account” or “Registration” button prominently displayed on the homepage.

- Complete the Registration Form:

- Personal Information:

- Enter your full name as it appears on your identification documents.

- Provide a valid email address for communication and account verification purposes.

- Submit your phone number, including the country code, to facilitate contact if necessary.

- Account Details:

- Choose your preferred account type (e.g., Standard, Eurica, Cent.Standard, Cent.Eurica) based on your trading needs.

- Select the desired leverage ratio, ranging from 1:1 to 1:1000, keeping in mind that higher leverage involves greater risk.

- Decide on the base currency for your account, typically USD or EUR.

- Password and Security:

- Create a strong password to secure your account.

- Set a code word, which will be used for account recovery and verification purposes.

- Agree to Terms and Conditions:

- Carefully read the Public Offer Agreement and other relevant documents.

- Confirm your acceptance by checking the appropriate box.

- Submit the Registration Form:

- After ensuring all information is accurate, click on the “Open Account” button to proceed.

- Receive Account Credentials:

- Upon successful registration, you will receive an email containing your trading account number, trader password, phone password, and PIN code.

- These credentials are essential for accessing your Client Cabinet and trading platforms.

- Verify Your Account:

- Identity Verification:

- Upload a scanned copy or a clear photo of a valid government-issued ID (e.g., passport, national ID card, or driver’s license).

- Address Verification:

- Provide a recent utility bill or bank statement (dated within the last three months) displaying your name and residential address.

- The verification process typically takes up to 72 hours.

- Fund Your Account:

- Log in to the Client Cabinet:

- Use your account number and trader password to access your personal area.

- Choose a Deposit Method:

- Select from various options, including bank transfers, credit/debit cards, and electronic payment systems like Skrill or Neteller.

- Enter Deposit Amount:

- Specify the amount you wish to deposit, adhering to any minimum deposit requirements associated with your chosen account type.

- Confirm the Transaction:

- Follow the on-screen instructions to complete the deposit process.

- Download and Set Up the Trading Platform:

- Select a Platform:

- InstaForex supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

- Download the Platform:

- Visit the InstaForex website’s “Trading Platforms” section to download the platform compatible with your operating system (Windows, Mac, iOS, Android).

- Install and Log In:

- Install the platform and log in using your account number and trader password.

- Register Online: Visit the InstaForex website, click "Open Account," and fill in your personal details, account type, leverage, and base currency.

- Set Security Details: Create a strong password and set a code word for account recovery and verification.

- Agree and Submit: Accept the terms, submit the registration form, and receive your account credentials via email.

- Verify Your Account: Upload a valid ID and proof of address; verification typically takes up to 72 hours.

- Fund and Start Trading: Log in, deposit funds using your preferred method, download the MetaTrader platform, and begin trading.

InstaForex Charts and Analysis

InstaForex provides a comprehensive suite of charting tools and analytical resources to support traders in making informed decisions.

Charting Tools:

- MetaTrader Platforms: InstaForex utilizes MetaTrader 4 (MT4) and MetaTrader 5 (MT5), renowned for their advanced charting capabilities. Traders can access multiple chart types, including line, bar, and candlestick charts, across various timeframes from one minute to one month.

- Technical Indicators: Both platforms offer a wide array of built-in technical indicators, such as Moving Averages, Bollinger Bands, and the Relative Strength Index (RSI). These tools assist traders in analyzing market trends and identifying potential entry and exit points.

- Customizable Templates: Traders can create and save personalized chart templates, allowing for efficient application of preferred settings and indicators across different instruments.

Analytical Resources:

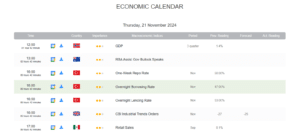

- Economic Calendar: InstaForex provides an up-to-date economic calendar featuring key global economic events and indicators. This tool helps traders anticipate market movements influenced by economic data releases.

- Market News: The broker offers real-time market news and analysis, covering various financial markets. This information aids traders in staying informed about factors affecting market dynamics.

- Analytical Reviews: InstaForex’s team of experts regularly publishes analytical reviews and forecasts, providing insights into market trends and potential trading opportunities.

Usability for Different Trading Styles:

- Beginners: The user-friendly interface of the MetaTrader platforms, combined with educational resources, makes it accessible for novice traders to learn and apply technical analysis.

- Intermediate Traders: The extensive range of indicators and customizable features cater to traders with some experience, allowing them to refine their strategies.

- Advanced Traders: Advanced charting tools, the ability to implement custom indicators, and access to in-depth market analysis support sophisticated trading strategies.

InstaForex’s robust charting and analytical tools are designed to accommodate traders of all levels, enhancing their ability to analyze markets and execute informed trading decisions.

InstaForex Account Types

InstaForex offers a variety of account types to cater to different trading needs and experience levels. Below is a summary of the available account options:

| Account Type | Base Currency | Minimum Deposit | Spreads | Commissions | Minimum Trade Size | Maximum Trade Size | Leverage | Suitable For |

| Insta.Standard | USD, EUR | $1 | Fixed (3-7 pips) | None | 0.01 lots | 10,000 lots | Up to 1:1000 | All types of traders |

| Insta.Eurica | USD, EUR | $1 | Zero | 0.03%-0.07% | 0.01 lots | 10,000 lots | Up to 1:1000 | Beginners and professionals seeking zero spread trading |

| Cent.Standard | USD Cents, EUR Cents | $1 | Fixed (3-7 pips) | None | 0.10 lots | 10,000 lots | Up to 1:1000 | Beginners needing minimal risk and lower trade volumes |

| Cent.Eurica | USD Cents, EUR Cents | $1 | Zero | 0.03%-0.07% | 0.10 lots | 10,000 lots | Up to 1:1000 | Beginners preferring zero spread with minimal risk |

Each account type is designed to accommodate specific trading strategies and preferences, providing flexibility and a range of options for InstaForex clients.

Do I Have Negative Balance Protection with This Broker?

Yes, InstaForex provides negative balance protection to its clients, ensuring that traders cannot lose more money than they have deposited into their accounts. This feature is crucial in volatile markets, as it prevents traders from incurring debts to the broker due to adverse market movements.

Understanding Negative Balance Protection:

Negative balance protection is a safety mechanism that limits a trader’s potential losses to the amount of funds available in their trading account. In scenarios where market volatility leads to significant losses, this protection ensures that the trader’s account balance does not fall below zero.

InstaForex’s Implementation:

InstaForex manually adjusts any negative balances back to zero, in accordance with governing legislation. This means that if a client’s account becomes negative due to unsuccessful trading, the company will reset the balance to zero, safeguarding the trader from owing money to the broker.

Impact on Risk Management:

The provision of negative balance protection by InstaForex enhances a trader’s risk management strategy by:

- Limiting Financial Exposure: Traders are assured that their maximum potential loss is confined to their initial investment, preventing additional financial liabilities.

- Encouraging Responsible Trading: While this protection offers a safety net, it also promotes prudent trading practices, as traders are still responsible for managing their risks effectively.

In summary, InstaForex’s negative balance protection policy provides traders with an added layer of security, ensuring that they are not liable for losses exceeding their account balance, thereby fostering a safer trading environment.

InstaForex Deposits and Withdrawals

InstaForex offers a variety of deposit and withdrawal methods to accommodate the diverse needs of its clients. Below is an overview of the available options, along with their associated fees and processing times.

Deposit Methods:

| Method | Currency | Processing Time | Fees |

| Bank Card | USD/EUR | Up to 24 hours | None |

| Skrill | USD/EUR | Up to 24 hours | None |

| Bank Wire | EUR | 2-4 business days | Bank fees apply |

| Neteller | USD/EUR | Instant | None |

| PayCo | USD | Instant | None |

| Bitcoin | USD | Up to 3 hours | None |

| Litecoin | USD | Up to 3 hours | None |

| Tether | USD | Up to 3 hours | None |

| PayLivre (Brazil) | USD | Up to 24 hours | None |

| Southeast Asia Bank Transfers | IDR/MYR/THB/VND | 1-7 business hours | None |

| Local Transfers | IDR/MYR/CNY/PKR/THB | 1-2 business hours or 1-2 bank days | Bank fees apply |

Note: Processing times are approximate and may vary based on individual circumstances.

Withdrawal Methods:

| Method | Currency | Processing Time | Fees |

| Bank Card | USD/EUR | 1-6 business days | 2.5% + 3.50 EUR/USD |

| Skrill | USD/EUR | 1-7 business hours | 1.39% |

| Bank Wire | EUR | 2-4 business days | 2% |

| Neteller | USD/EUR | 1-7 business hours | 2% (additional 1 USD fee for amounts less than 50 USD) |

| PayCo | USD | 48 hours | Payment system fee |

| Bitcoin | USD | 1-7 hours | 0.5% |

| Litecoin | USD | 1-7 hours | 0.5% |

| Tether | USD | Up to 3 hours | None |

| Local Transfers | IDR/MYR/CNY/PKR/THB | 1-7 business hours | Bank fees apply |

Note: Withdrawal processing times are approximate and may vary based on individual circumstances.

Additional Information:

- Minimum and Maximum Transaction Amounts: These vary depending on the chosen method. For instance, the minimum deposit for bank cards is typically $1, while for bank wires, it may be higher.

- Processing Times: While many methods offer instant or near-instant processing, bank transfers can take several business days.

- Fees: InstaForex does not charge fees for deposits. However, withdrawal fees vary depending on the method used.

It’s important to note that withdrawals are generally processed using the same method and account details as the original deposit. If multiple deposit methods are used, withdrawals are processed proportionally.

For the most accurate and up-to-date information, clients are advised to consult the official InstaForex website or contact their customer support.

Support Service for Customer

InstaForex offers a comprehensive customer support system to assist traders with their inquiries and technical needs.

Support Channels:

- Live Chat: Available 24/7, providing immediate assistance through the InstaForex website.

- Email Support: Clients can reach out via email at [email protected] for detailed inquiries.

- Phone Support: Telephone assistance is available, with contact numbers provided on the InstaForex website.

- Social Media: Support is also accessible through platforms like WhatsApp, Viber, Telegram, and Twitter.

Response Times:

InstaForex aims to provide prompt responses across all support channels. Live chat typically offers immediate assistance, while email inquiries are addressed within 24 hours. Phone support availability may vary based on regional offices.

Availability Hours:

Customer support operates 24/7, ensuring assistance is available at any time.

Languages Supported:

Support is primarily offered in English, with additional languages available depending on regional offices and support staff capabilities.

InstaForex’s commitment to accessible and responsive customer support enhances the overall trading experience for its clients.

Prohibited Countries: Where Can I Not Trade with this Broker?

InstaForex operates under various international regulations, which necessitate restrictions on providing services to residents of certain countries. These prohibitions are primarily due to legal constraints, compliance with international sanctions, and adherence to anti-money laundering (AML) regulations.

Restricted Countries:

- United States: Due to stringent financial regulations and licensing requirements, InstaForex does not accept clients from the U.S.

- Canada: Similar to the U.S., Canada’s regulatory environment restricts InstaForex from offering services to Canadian residents.

- Japan: Japanese financial regulations and licensing requirements prevent InstaForex from operating within the country.

- Belgium: Regulatory constraints in Belgium prohibit InstaForex from providing services to its residents.

- Iran: International sanctions and regulatory issues restrict InstaForex’s operations in Iran.

- North Korea: Due to international sanctions, InstaForex does not offer services to North Korean residents.

- Afghanistan: Security concerns and regulatory challenges prevent InstaForex from operating in Afghanistan.

- Syria: Ongoing conflicts and international sanctions restrict InstaForex’s services in Syria.

Implications for Potential Clients:

Residents of the aforementioned countries are prohibited from opening trading accounts with InstaForex. This is to ensure compliance with international laws and to maintain the integrity of financial operations. Potential clients are advised to verify their eligibility before attempting to register for an account. For the most current information on allowed and restricted countries, it is recommended to check the official InstaForex website or contact their customer support directly.

By adhering to these restrictions, InstaForex ensures compliance with global financial regulations and maintains a secure trading environment for its clients.

Special Offers for Customers

InstaForex provides a variety of promotions and bonuses to enhance the trading experience for its clients. Below is an overview of the current special offers:

- Welcome Bonus 100%

- Description: New clients receive a 100% bonus on their first deposit, effectively doubling their initial trading capital.

- Eligibility: Available to all new clients upon their first deposit.

- Terms: The bonus is credited only once per client and is not compatible with other bonus types.

- 55% Bonus on Every Deposit

- Description: Clients receive a 55% bonus on every deposit made into their trading account.

- Eligibility: Available to all clients for each deposit.

- Terms: The bonus is credited automatically upon deposit and can be used for trading purposes.

- 30% Bonus

- Description: Clients receive a 30% bonus on each deposit, enhancing their trading potential.

- Eligibility: Available to all clients for each deposit.

- Terms: The bonus is credited automatically and can be combined with the InstaForex Club bonus for additional benefits.

- InstaForex Club Bonus

- Description: Members of the InstaForex Club receive additional bonuses up to 40% on each deposit.

- Eligibility: Requires membership in the InstaForex Club.

- Terms: The bonus can be combined with other bonuses, providing enhanced trading benefits.

- Chancy Deposit

- Description: By topping up their account with at least $3,000, clients automatically become participants in a monthly promotion with a prize fund of $50,000.

- Eligibility: Clients who deposit at least $3,000 during the promotion period.

- Terms: The winner is determined randomly, and the prize is credited to the trading account.

- Special Bonus

- Description: New clients receive a $1,500 welcome bonus automatically upon account opening, allowing them to practice trading strategies without initial investment.

- Eligibility: Available to new clients upon account registration.

- Terms: The bonus is for practice purposes and cannot be withdrawn.

How to Qualify:

- Account Registration: Open a live trading account with InstaForex.

- Deposit Funds: Make the required deposit amount to qualify for the desired bonus.

- Apply for Bonus: Submit a bonus application through the Client Cabinet or during the deposit process.

Associated Terms:

- Verification: Some bonuses may require account verification.

- Withdrawal Conditions: Profits earned from bonuses can be withdrawn after meeting specific trading volume requirements.

- Compatibility: Certain bonuses cannot be combined; clients should review terms to understand compatibility.

For detailed information and the most current terms and conditions, clients are advised to visit the official InstaForex website or contact customer support.

InstaForex Review Conclusion: Reputable Broker with Easy-to-use Platform

InstaForex, established in 2007, has positioned itself as a prominent player in the online trading industry, offering a wide array of financial instruments and user-friendly platforms.

Strengths:

- Diverse Asset Selection: Traders have access to over 300 instruments, including forex pairs, commodities, indices, and cryptocurrencies, catering to various trading preferences.

- User-Friendly Platforms: Utilizing MetaTrader 4 and MetaTrader 5, InstaForex provides robust and intuitive trading environments suitable for both beginners and seasoned traders.

- Flexible Account Options: With multiple account types, including Cent and Standard accounts, InstaForex accommodates traders with varying experience levels and investment capacities.

- Educational Resources: The broker offers a wealth of educational materials, including webinars, tutorials, and market analyses, supporting traders in making informed decisions.

Areas for Improvement:

- Regulatory Status: While InstaForex is regulated by the Financial Services Commission (FSC) in the British Virgin Islands, it lacks oversight from top-tier regulatory bodies, which may be a consideration for some traders.

- Geographical Restrictions: Services are unavailable in certain countries, including the United States and Canada, limiting access for potential clients in these regions.

Usability and Suitability:

InstaForex’s platforms are designed for ease of use, featuring customizable interfaces and a range of analytical tools. The availability of demo accounts allows new traders to practice without financial risk, while experienced traders can benefit from advanced features and competitive trading conditions.

Conclusion:

InstaForex stands out as a reputable broker offering a comprehensive suite of trading instruments and user-friendly platforms. Its commitment to providing educational resources and flexible account options makes it a viable choice for traders at all levels. However, potential clients should consider the broker’s regulatory status and geographical limitations when making their decision.

Summary and Key Takeaways

In summary, InstaForex offers a comprehensive trading experience with a wide array of instruments and supportive resources. Prospective clients should assess the broker’s regulatory framework and regional availability to ensure alignment with their trading requirements.

- Diverse Asset Selection: Traders have access to over 300 instruments, including forex pairs, commodities, indices, and cryptocurrencies, catering to various trading preferences.

- User-Friendly Platforms: Utilizing MetaTrader 4 and MetaTrader 5, InstaForex provides robust and intuitive trading environments suitable for both beginners and seasoned traders.

- Flexible Account Options: With multiple account types, including Cent and Standard accounts, InstaForex accommodates traders with varying experience levels and investment capacities.

- Educational Resources: The broker offers a wealth of educational materials, including webinars, tutorials, and market analyses, supporting traders in making informed decisions.

- Regulatory Status: While InstaForex is regulated by the Financial Services Commission (FSC) in the British Virgin Islands, it lacks oversight from top-tier regulatory bodies, which may be a consideration for some traders.

- Geographical Restrictions: Services are unavailable in certain countries, including the United States and Canada, limiting access for potential clients in these regions.

FAQs

About Author

Beatrice Quinn

Beatrice Quinn Kingsley, a finance graduate from the London School of Economics, dove into finance clubs during her studies, honing her skills in portfolio management and risk analysis. With a career spanning prestigious firms like Barclays and HSBC, she's become an authority in asset allocation and investment strategy, known for her insightful reports. Beyond her corporate success, Beatrice is an advocate for financial literacy, actively engaging in workshops, seminars, and writing on topics like personal finance and investing. Recognized in the field, she's a featured voice in publications and a sought-after consultant, combining her financial know-how and communication prowess to empower ...User Reviews

Be the first to review “InstaForex Review: Versatile Trading and Investment Opportunities” Cancel reply

- InstaForex Overviews

- Pros and Cons

- Is InstaForex Safe? Broker Regulations

- What Can I Trade with InstaForex?

- How to Trade with InstaForex?

- How Can I Open InstaForex Account? A Simple Tutorial

- InstaForex Charts and Analysis

- InstaForex Account Types

- Do I Have Negative Balance Protection with This Broker?

- InstaForex Deposits and Withdrawals

- Support Service for Customer

- Prohibited Countries: Where Can I Not Trade with this Broker?

- Special Offers for Customers

- InstaForex Review Conclusion: Reputable Broker with Easy-to-use Platform

- Summary and Key Takeaways

- FAQs

- About Author

There are no reviews yet.